TSMC, NVIDIA and INTEL - Giants in the world of artificial intelligence

19.04.2024

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the game when it comes to AI chips. You've probably heard of TSMC (Taiwan Semiconductor Manufacturing Company), Intel and NVIDIA. But have you looked deeper into what they are producing, how it affects the market, and most importantly how it affects you?

These huge businesses are all key players in the semiconductor industry, but their roles differ.

TSMC is based in Taiwan and surely is the world's largest independent semiconductor foundry. It manufactures chips for a wide range of companies, including those in the consumer electronics, automotive, and industrial sectors. TSMC doesn't design its chips; rather, it produces chips based on designs provided by its clients, which include companies like Apple, Qualcomm, AMD, NVIDIA, and many others.

Intel, on the other hand, is a major semiconductor company that both designs and manufactures its chips. Historically dominant in PC and server processors, Intel faces competition from companies like AMD and NVIDIA. Its chips power a wide array of devices, from personal computers to data centers.

NVIDIA focuses on designing graphics processing units (GPUs) used in gaming, professional visualization, and data centers. While NVIDIA designs its chips, it relies on foundries like TSMC for manufacturing.

Now that we've explained the main differences between these giants let's take a look into how they are performing. In this article, we will mainly focus on TSMC as a main producer of chips. But we will touch points on its relations to the other two businesses.

TSMC Q1 beats expectations on AI demand

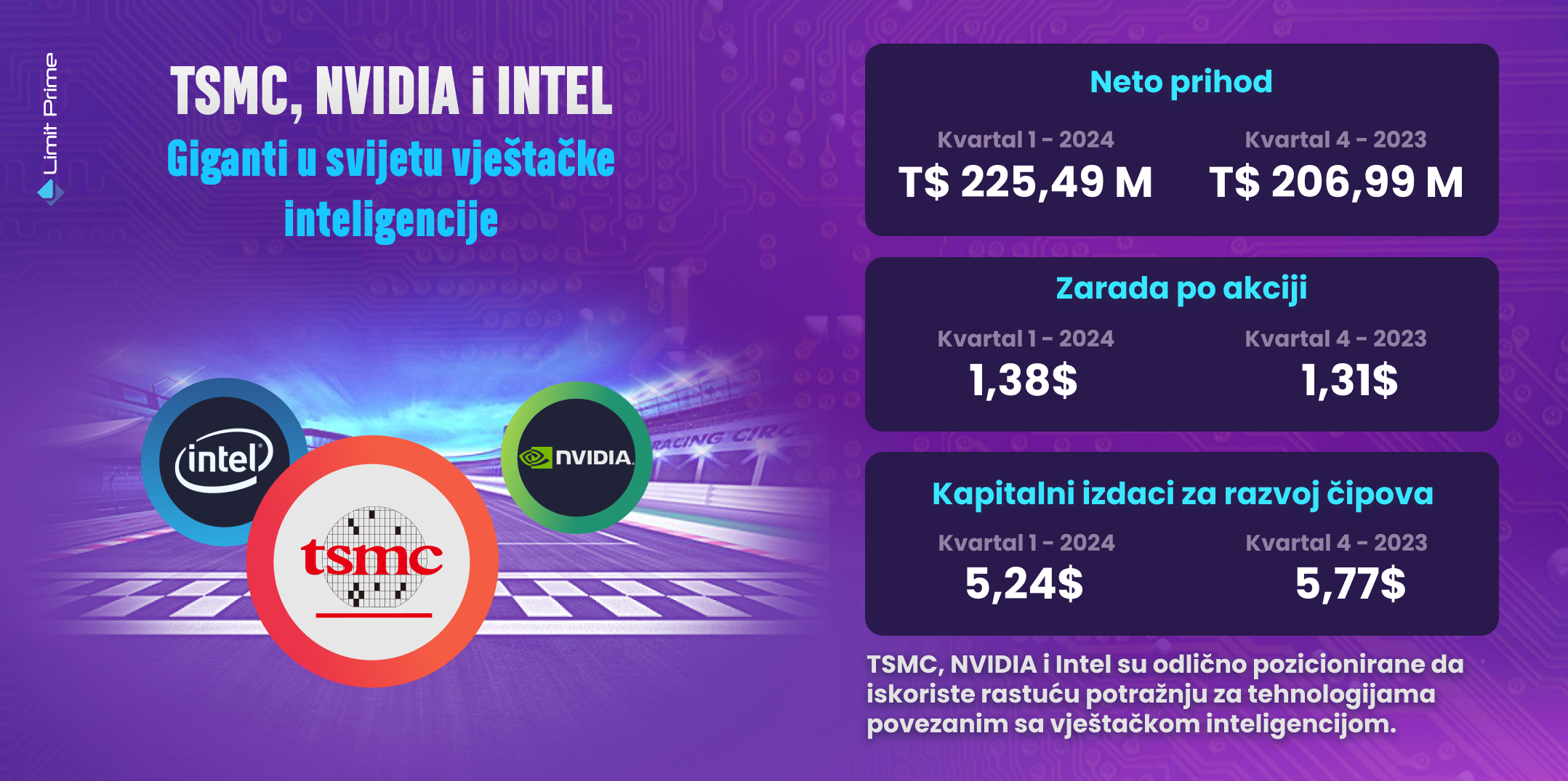

TSMC delivered an excellent first-quarter performance, driven by surging demand in the growing artificial intelligence (AI) sector. Net income for the three months ending March 31 reached an impressive T$225.49 billion, exceeding Reuters' estimates of T$218.1 billion ($6.7 billion) and marking a notable increase from the previous year's T$206.99 billion.

Diluted earnings per share for Q1 stood at T$8.70 or $1.38 per American Depository Receipt, reflecting a significant improvement compared to last year's $1.31. However, despite remarkable yearly performance, quarterly net income experienced a slight decline of 5.5%, hinting at potential softening demand from the peak levels seen in 2023.

TSMC incurred higher costs for chip development, with capital expenditures rising to $5.77 billion in Q1 2024 from $5.24 billion in the previous quarter. First-quarter revenue surged by 16.5% to T$592.64 billion, driven by increased demand and a more favorable comparison base due to weaker chip demand in 2023. Moreover, weakness in the Taiwan dollar during the first quarter boosted TSMC's dollar earnings.

TSMC & NVIDIA

The recent boost in earnings is all thanks to the soaring demand for chips in the AI sector. TSMC's earnings are like a litmus test for the chip demand worldwide, mainly because they're a big deal in the chipmaking game.

How do TSMC and Nvidia complement each other? Nvidia keeps TSMC on its toes with its hunger for the latest AI chips on the market.

Speaking of Nvidia's wild ride over the past year, it's been a major factor in driving up TSMC's value. This close relationship between the two tells us a lot about how interconnected their success is. TSMC's pivotal role in supplying advanced chip technology to Nvidia underscores its integral position within the tech ecosystem, further solidifying its status as a key player driving innovation in the semiconductor industry.

Read more about Nvidia and its success here.

NVIDIA is estimated to report earnings on 22 May 2024.

TSMC & INTEL

This month, Intel shared some tough news about its foundry business—it's facing even bigger losses. This is a setback for Intel as it's trying hard to catch up with TSMC, which has been ahead in technology for a while now. To make things more interesting, TSMC also said they're building another factory in Arizona. This means the competition between Intel and TSMC is getting even fiercer. Intel's struggle with increasing losses adds more challenge to its goal of catching up with TSMC, which is a big player in the chip world.

Intel is estimated to report earnings on 25 April 2024.

With 29% down this year, we can’t wait to see what lies ahead for Intel’s stock.

What does this mean for you?

The stocks of these companies have crucial roles in the AI ecosystem. Investing in TSMC, NVIDIA, and Intel presents an eye-catching opportunity for several reasons. As market leaders in their respective segments, they stand to benefit from the growing demand for AI-related technologies across different sectors. Their established positions and revenue streams provide stability while tapping into the expanding AI market. These companies keep up with the latest tech by always putting money into research and development. They also team up with others and generate profits making them more attractive to investors. Also, as AI becomes a bigger part of different industries, these companies are like gold mines for investors who want to invest in the AI and tech sectors.

Conclusion

In conclusion, investing in TSMC, NVIDIA, and Intel offers a promising opportunity amidst the evolving landscape of AI and technology. These companies, with their market leadership, diversified revenue streams, and commitment to innovation through research and development, are well-positioned to capitalize on the growing demand for AI-related technologies. Their strategic partnerships and pivotal roles in the semiconductor industry further enhance their appeal to investors. As AI continues to integrate into various sectors, investing in these companies provides a gateway to potential long-term growth and opportunities in the dynamic tech market.

LimitPrime © 2026

Categories

Pustite komentar

Comments

PREBERITE VEČ ZANIMIVIH ČLANKOV

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Preberite več

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Preberite več

Leading artificial intelligence (AI) stocks have surged in value over the previous year and produced amazing gains. It looks likely tha...

Preberite več