What Is a Pip?

Traders use pips in various calculations throughout their trading process. They commonly use pips when they want to calculate their spread cost, the amount of money needed to buy/ sell an asset, their potential earnings, or unwanted losses. In saying that, a pip is the most basic unit of measure in trading. For every trader it is important to know, not only what is a pip, but how to calculate its value and how it relates to a certain asset.

What is a Pip and how to calculate it?

A pip stands for “price interest point” and we can find it in every change of the value of a currency pair or any other asset.

Movement in the exchange rate is measured by pips.

For example, when traders look at a certain currency pair, they’ll see two prices (sometimes only one) expressed in decimal numbers. These two prices contain one pip each. The 4th decimal place of the price shown is called a pip, with an exception of the Japanese Yen, where all currency pairs that include JPY have a pip on the 2nd decimal place. From this, we can conclude that a single pip change is equivalent to 0.0001 (except JPY currency pairs).

Since the prices are always changing, the pip is changing, too. Therefore, we can also say that a pip is a measure of the price change.

If the price for a currency pair GBP/USD moves from 1.3332to 1.3333, we say that the price has increased by one pip.

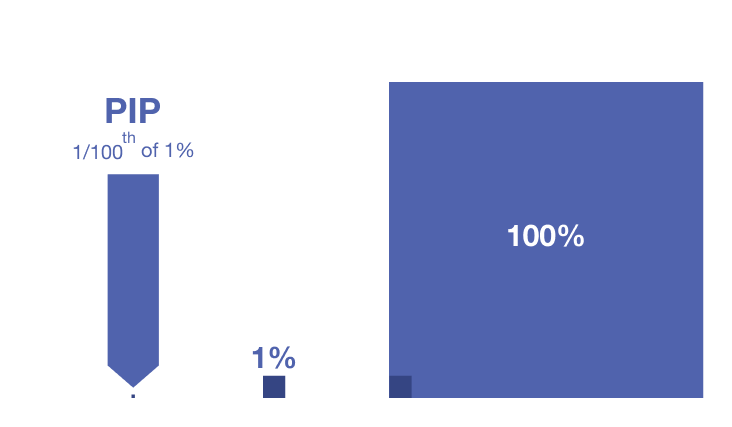

When it comes to calculations, the pip is equivalent to 1/100th of 1%. Visually, we can represent it like this:

What is a Pipette?

Now that we’ve introduced the pip, we can move on to the pipette.

A pipette, or a fractional pip, is a tenth of a pip and so it’s the 5th decimal place. (But, where a pip is the 5th decimal place, a pipette is the 6th decimal place)

What is a Pip value?

Another term we need to explain is a pip value. A pip value is a price attributed to a one pip change.

Factors that affect the pip value are: the currency pair traded, the size of the trade (lot size) and the exchange rate of the currency pair. To explain the calculation of a pip value, we will use an example.

For instance, you want to trade on the foreign exchange market with the USD/CHF currency pair. For the USD/CHF, the prices are as follows: 0.9101(the bid price) and 0.9104(the ask price).

Let’s say that you want to open a position with the standard contract size of 100,000 units (equal to 1 lot). The formula for pip value goes like this:

Pip value = (Size of a pip / Exchange rate) x Contract size

- Here, the difference between the bid and the ask price is in 3 pips or 0.0003 pip size (0.9101 and 0.9104).

- The exchange rate is expressed through the buying price (or ask price) and it’s 0.9104.

- The contract size is 100,000.

With these data, our final calculation is:

Pip value = (0.0003 / 0.9104) x 100,000 = 32.95

This means that you bought 100,000 USD against CHF at the buying price of 0.9104 and you earned $32.95 for every pip increase in your favor.

Note: If a currency pair you want to trade is EUR/USD, the pip is 1 and the contract size is standard (100,000 units), in this case, the pip value will always be $10.

This also applies to every other currency pair where USD is the counter currency, such as: GBP/USD, AUD/USD and NZD/USD.

To conclude, when USD is a second currency and we’re trading:

- a standard lot (100,000 units), pip value is $10;

- a mini lot (10,000 units), pip value is $1;

- a micro lot (1,000 units), pip value is $0.1;

- a nano lot (100 units), pip value is $0.01.

Conclusion

Traders must understand the definition of a pip even before they open their first position. A pip is a basic unit of measurement commonly used in forex trading and other online financial markets. A pip is the last decimal place of the price quote, which is usually the 4th decimal place.

A pipette is smaller than a pip and comes on its right side, which is the 5th decimal place.

For calculations, traders use a pip value which is a price connected to a one pip change. To find out a pip value, we use a specific formula that contains three elements: the size of a pip, exchange rate (express through the buying price) and contract size.

Sources Consulted:

1. Lee, M. What is a pip? https://www.investopedia.com/ask/answers/06/pipexplained.asp (2020)

2. Chen, J. Pip Definition. https://www.investopedia.com/terms/p/pip.asp (2021)

3. What is a pip in forex? https://www.babypips.com/learn/forex/pips-and-pipettes (2011)

LimitPrime © 2026

Begin to invest and

start earning today!

Categories

Do you need personalized assistance?

READ MORE INTERESTING ARTICLES

Diversificationnoun the action of diversifying something or the fact of becoming more diverse. a trading strategy that reduces risk. D...

Read More

As any risk disclosure will tell you, trading financial instruments put the trader at risk of losing some or all of their allocated cap...

Read More

What are indices?Indices measure the performance of a group of stocks, bonds or other investments. These investments are often grouped...

Read More