COMMODITIES

CFD Commodities

What is Commodity Trading?

Commodities simple as bread, rice, milk are basic goods, a necessity of human life.

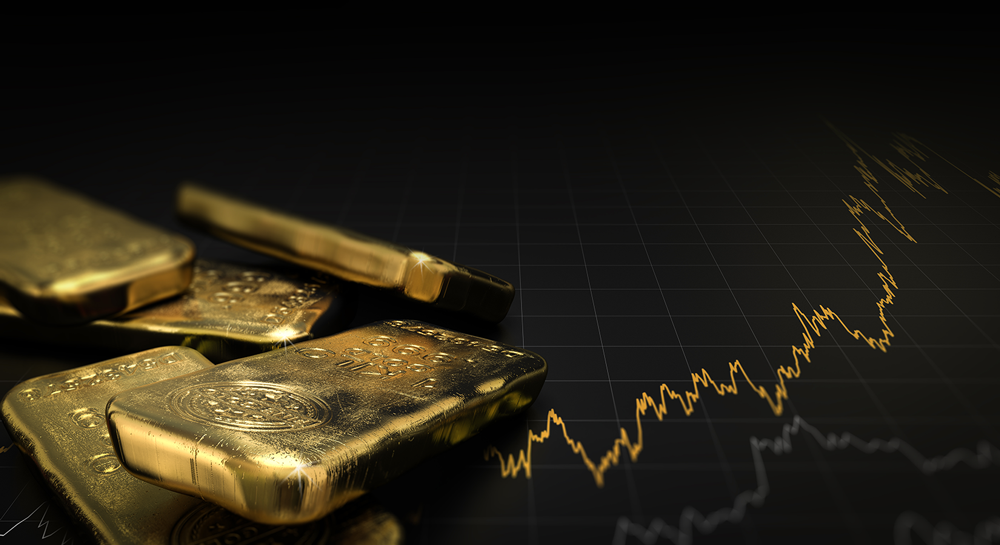

But for investors, commodities such as: gold, platinum, silver, oil, grains are also a necessity and an important part of their portfolios. In the capital market, these instruments tend to offer more security, especially in times when the markets are erratic.

The commodity market is one of the oldest financial markets, basically an ancient one. Trading commodities has a longer history than trading stocks and bonds. In the past trading of these goods was only done by professional traders, it required money, time and expertise.

But thanks to the improvement of technology, it has never been more accessible to the public. There is a significant number of increased options for participating in the trading markets made for every trader.

Trading CFD commodities doesn’t actually mean that traders are owning them. CFD commodities allow investors to speculate on the price movements and an advantage here is being exposed to leverage, where the trader is able to use less capital to gain greater exposure to an underlying instrument, increasing the potential for profits, as well as losses.

Types of Commodities:

- Metals

- Crude Oil

It is also relevant to mention that about a third of global oil demand is from cars, and 40 percent of the growth since the year 2000 has come from the automobile industry.

Energy trading involves assets like oil and natural gas. The most-traded one is Crude oil. Its price also determines the price of gasoline and natural gas and it has been favorite oil between swing and day traders. Demand is generally the highest during the summer and winter months, but for different reasons. During the summer, increased driving boosts the demand for crude oil and causes prices to rise. During the winter, a higher demand for heating oil causes prices to move higher.

- Agriculture products

Even a soft futures contract exists. It is a legally binding agreement for the delivery of cocoa, coffee, cotton, frozen concentrated orange juice and sugar in the future at an agreed upon price. These types of trades have: quantity, quality, time, and place of delivery.

But in reality, considering how many opportunities you have thanks to the new technology, you can profit simply from: speculations based on price movements.

And not by actually buying and reselling some cocoa, sugar, cotton etc.

Why invest in Commodities?

Commodities act as a shield against inflation - Historically commodities have had a positive connection with inflation. Inflation is measured by tracking the price of goods and services which often contain commodities directly, as well as products closely related to commodities.

They make your portfolio less fragile - In moments of natural disaster, political scandals, geopolitical conflicts and inflation, commodities defend your portfolio from the rising prices.

Stability - The number one traded commodity in the world is gold. It’s an investment that has a unique value for investors, it is generally stable and balanced.

COMMODITIES

Start TradingHow to Trade CFD Commodities?

Limit Prime Securities offers you the possibility of trading with various ranges of CFD commodities, including worldwide popular commodities. Ones that you can exclusively trade.

Trading commodities has never been easier.

Here is what you need to do:

- Open an account

- Fund your trading account

- Start trading

One of the best advantages of trading with CFD is leverage. It most certainly has its own risks, but we protect our trusted clients from a negative balance, meaning you cannot lose more money than you previously deposited.

The leverage ratio when trading gold is 1:100 in the territory of Montenegro.

Example: For every $1,000 deposited in your account, you can trade up to $100,000 in value.

Moreover, for all of our clients coming from other countries the leverage ratio is 1:150.

Things to consider before making your first trade:

1: Select your market.

Decide on what type of commodity you want to trade. With Limit Prime Securities, you can choose all popular commodities such as Oil, Gold and different Grains. See the trading conditions here.

2: Set the volume of the trade and direction of your trade.

Once you have decided on the type of commodity you want to trade, you need to decide how many units you want to purchase. If you think prices will rise in the near future, you can buy a commodity or "go long". If you think prices will fall, you can Sell it or "go short".

Notice that you can control trading risks by putting a Stop Loss order and Stop Limit (Close at profit). Which are features on our MetaTrader5 platform.

3: Monitor your position.

After a trade is placed, you should monitor its status and the funds available in the account.

Start trading commodities now.

List of Commodities - Montenegro

Read MoreList of Commodities - Other countries

Read More