Booking.com - Impressive Q4 Results

03.03.2023

Planning a trip abroad?

Well, first things first you need a flight to your destination and next, yeah you’ve guessed it, you need accommodation! The easiest way to book a room or a hotel abroad is through Booking.com. A name that is very familiar to our ears. Which is part of the largest online travel group in the world called Booking Holdings, formerly The Priceline Group.

Booking is not only helping you find accommodation where you are going to enjoy city views, but it also has so much more to offer. It could potentially bring you profits.

Here is why and most importantly how!

Booking (BKNG) News

With being the number one pick among investors, starring Emmy Award-winning, Academy Award, and Golden Globe-nominated American actress and producer Melissa McCarthy in their campaigns, and giving away 10,000$ in travel credits to 50 lucky winners, this travel enterprise is absolutely killing it.

Some other factors that are contributing to Booking's massive growth are the winter season and the number of reservations which is almost as similar to pre-pandemic levels.

Now let’s take a look at the key factor indicating the stock growth.

Booking (BKNG) Delivers Impressive Q4

Booking Holdings reported better-than-anticipated Q4 FY2022 earnings on 23/02/2023. With revenue rising 35.8% year over year to $4.05 billion. Booking increased its earnings from $618 million in the same quarter last year to $1.24 billion in GAAP terms. (Generally Accepted Accounting Principles).

Earnings per share were estimated at around 10.32$.

Growth in sales

With an average yearly growth rate of 41.4% over the last three years, Booking's revenue growth has been exceptional. The pandemic initially had a detrimental effect on Booking's revenue, but we are happy to announce that growth rates have returned to normal.

Growth in reservations

Booking grew its revenue by both growing the number of stays (or activities) booked and the percentage of commission taken from those reservations.

A crucial usage statistic for Booking over the previous two years was the number of nights booked, which increased by 101% yearly to 211 million people. Users appear to be enthusiastic about the offering because this company has experienced some of the quickest growth of any consumer internet company.

The company has a very optimistic outlook for investors. In growth with a market capitalization of $94.1 billion, more than $12.4 billion in cash, and positive free cash flow over the last 12 months.

It’s looking bullish!

Is Booking a good stock to invest, in right now?

The results speak for themselves!

From the beginning of 2023, Booking’s stock price didn’t catch a break. And it’s still increasing!

And at this time is exceptionally close to its highest levels ever. The highest stock price in Booking’s history was 2,618$, where currently is valued at 2,524$.

On January 3rd the stock was priced at 2,032$. Meaning that in a time frame of 2 months, the stock has increased to 492$ per share.

What is analysts' sentiment?

The 24 analysts offering 12-month price forecasts for Booking Holdings Inc have a median target of 2,725.00, with a high estimate of 3,000.00 and a low estimate of 2,100.00. The median estimate represents a +7.96% increase from the last price of 2,524$.

The current consensus among 31 polled investment analysts is to buy stock in Booking Holdings Inc. This rating has held steady since February when it was unchanged from a buy rating.

Hypothetical investment example

Booking share price 03/01/2023: 2,032$.

Current share price: 2,524$.

As previously said, the stock has had an increase of 492$ per share in a period of two months.

If you bought 10 BKNG stocks or,

10 x 492$ you’d have 4,920$ profit.

For buying 10 BKNG shares you’d need 20.320$.

But don’t worry, you can get the same profit with less money. By simply using leverage offered by Limit Prime which is 1:20 for stocks. With leverage, you get 20$ for every 1$ that you invest.

So, for buying 10 BKNG shares on 03/02/2023 you would’ve needed only:

2,032/20 = 101.6$ per share.

So with an investment of 1,016$, you would have been able to profit 4,920$, in a period of fewer than two months.

Conclusion

The rapid user growth that Booking experienced this quarter greatly amazed analysts and traders. They were also delighted to notice the remarkable revenue growth.

Looking at the whole quarter, we believe it was excellent.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

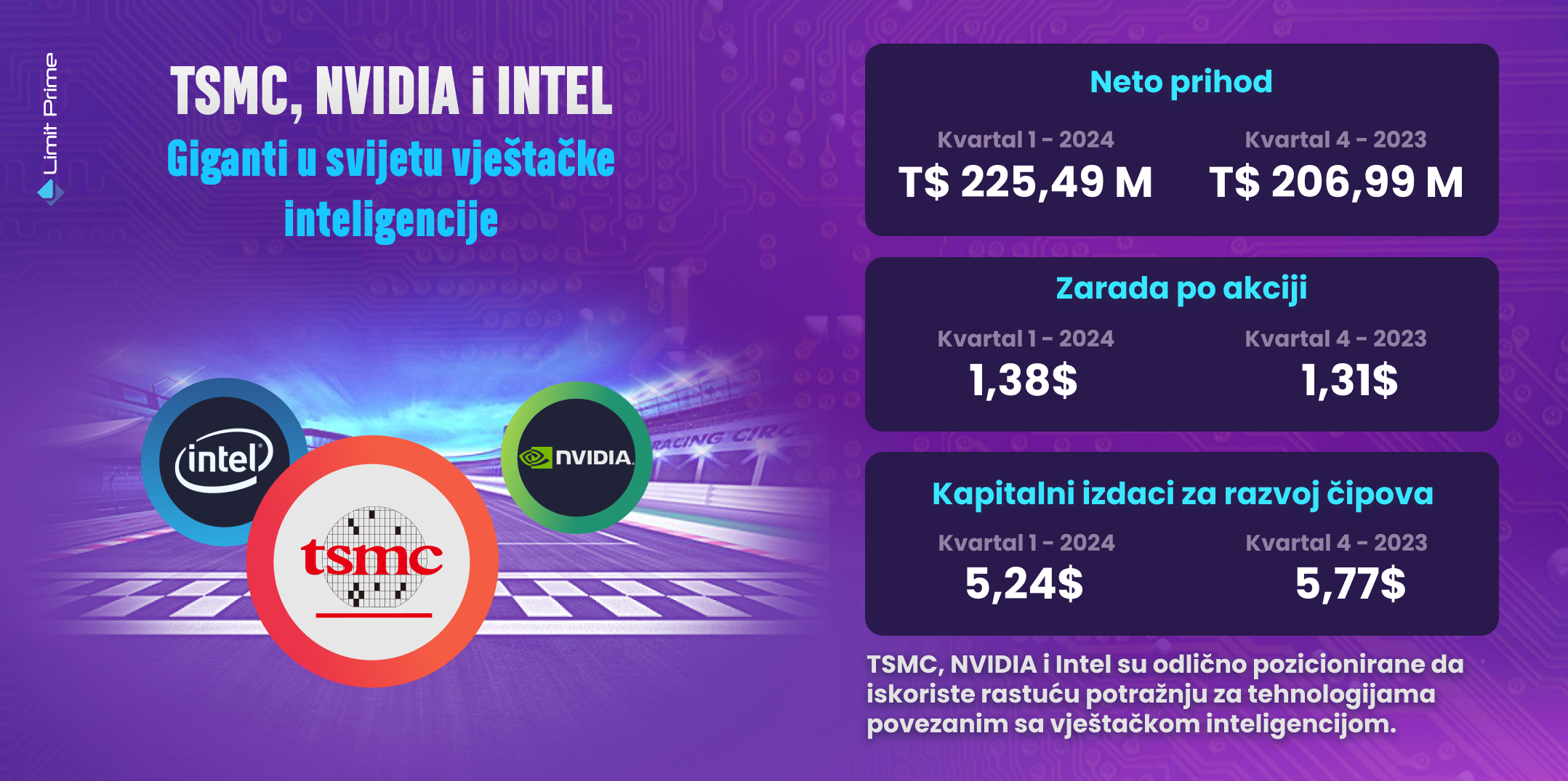

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More