Elon Musk is (not) buying Twitter

26.05.2022

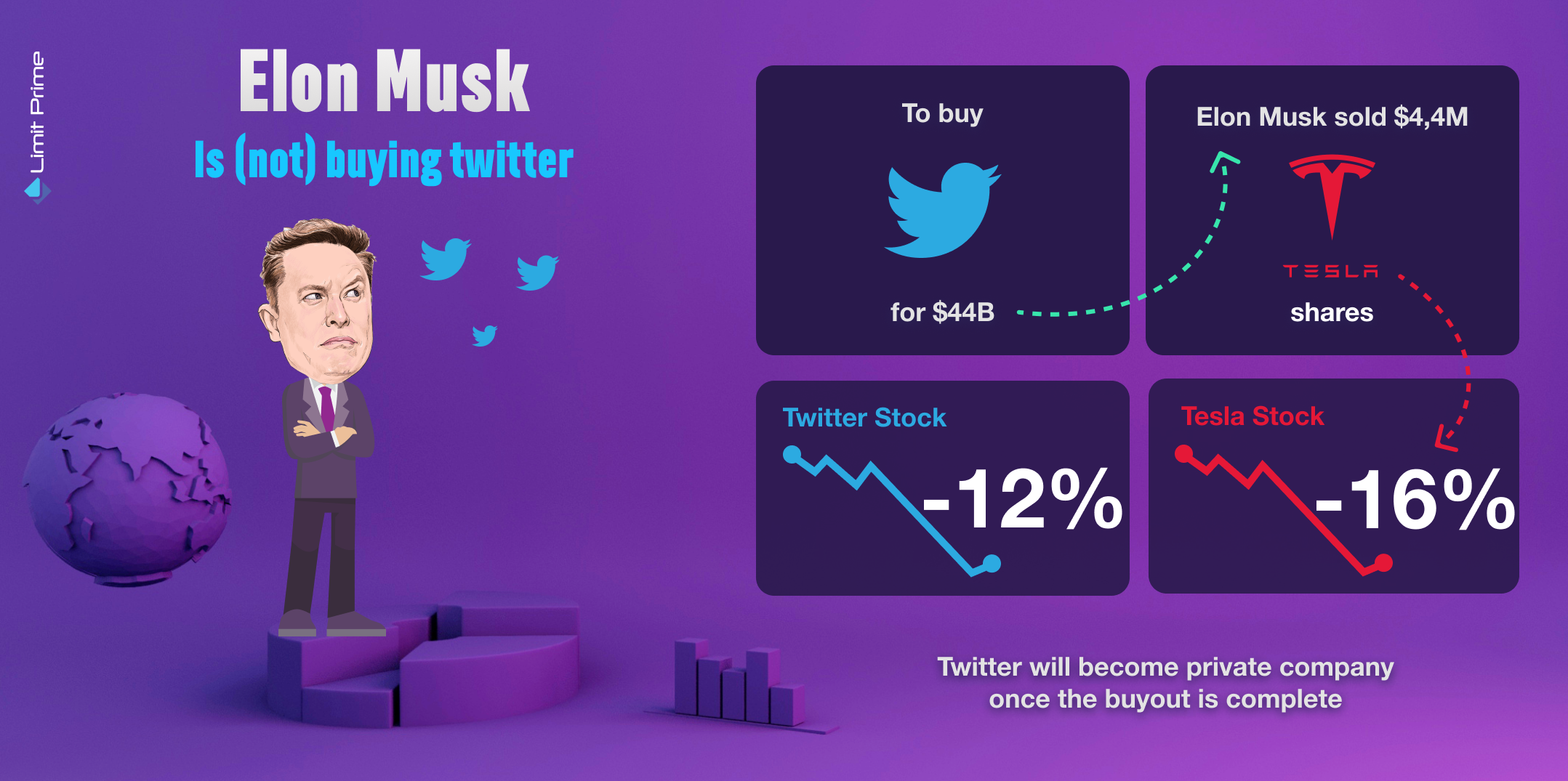

The analytical and ambitious businessman Elon Musk marked a day in history when he pledged to buy Twitter for $44 billion and this social media platform will become a private company once the buyout is completed in the near future.

When it comes to this public figure, it is obvious that his ability to think outside of the box and equally design, is influencing investors, traders and markets based on his different types of actions.

A timeline of the recent events

On April 4th, 2022, Tesla's CEO reported having made a purchase of 9.1% of Twitter’s shares, making him the biggest shareholder.

This phenomenon sent Twitter’s stock up in the air, increasing it by 27%. Making it extremely clear that his purchase of a huge portion in Twitter’s shares played a massive role in the stock market.

Elon’s becoming the biggest shareholder of Twitter and being involved in the decision-making process is obviously affecting the stock market.

But not only the changes he wanted to implement in this establishment, also his hilarious tweets, but announcements and engagement on Twitter have also had an impact on the stock market and cryptocurrencies such as Bitcoin too.

But the owner of 9.1% of Twitter didn't stop there, the motivation and desire to proceed in the Twitter buyout was becoming stronger. Elon had two goals in mind; to increase the ‘freedom of speech’ and protect democracy on this platform, making it a better place for all of its users.

There is no such thing as doubt when it comes to how much Elon loves his presence on this particular social media, how it helped him in the past and how easy it is to go ‘viral’.

The main wish to possess Twitter came to life when he sealed the deal on April 25th 2022.

But there was one obstacle. Funds! In order for such a purchase of $44 billion to go ahead, he had to sell 4.4 million shares of Tesla stock worth roughly $4 billion, which affected Tesla’s stock to the point of dropping by 12%, in one single day.

In addition to this, after Twitter accepted the offer, Tesla’s stock went down 16%.

After the rollercoaster of events in relation to sealing the deal to buy Twitter, its stock had dropped 10.5% amid a five day losing streak after Elon Musk put the buyout deal ‘temporarily on hold’, announcing this event through his tweet:

When it comes to this public figure, it is obvious that his ability to think outside of the box and equally design is influencing investors, traders and markets based on his different types of actions.

In addition to the spam/fake accounts on Twitter Elon claims that they represent 25% of the users on this huge platform.

So, he simply asked for a 25% discount on the Twitter bid, what is going to happen, we are going to find out on Wednesday 25th May.

He criticized Parag Agrawal, Twitter's chief executive, for publicly refusing "to show proof" that less than 5% of accounts were "fake/spam" and wrote that he was "worried that Twitter has a disincentive to reduce spam, as it reduces perceived daily users".

Elon Musk is unstoppable.

Another major event happened on May 18th 2022.

TESLA is dropped out of S&P 500

Tesla stock prices dropped more than 6%, down to roughly $715, around mid-day of May 18 after it was announced that the electric vehicle manufacturer lost its spot on the S&P 500 ESG index.S&P 500 ESG index stands for a stock market index that tracks 500 publicly traded domestic companies - considered as the best measurement for the stock market in the United States of America by many investors.

What caused this event?

Tesla joined the S&P 500 in December of 2020 and, after joining, it was the largest stock ever to join the index by rank and market capitalization. Following the news, the stock jumped 400%.

“While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens,” Margaret Dorn, Head of ESG Indices at S&P Dow Jones said in a blog post.

S&P 500 ESG Index removed Tesla (TSLA) related to claims of racial discrimination and car crashes of Tesla’s autopilot vehicles. Last year the National Highway Traffic Safety Administration (NHTSA) started digging into Tesla’s following series of crashes caused by the company’s autopilot.

The decision encouraged a bitter response from Tesla CEO Elon Musk, that said:

"Exxon is rated top ten best in the world for the environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list! ESG is a scam. It has been weaponized by phony social justice warriors."

Over the years, Tesla’s ESG score has been relatively solid and stable.

Based on speculations Elon Musk has discovered that half of Joe Biden’s followers on Twitter were bots or fake and this is the real reason why he was removed from S&P 500 ESG index, proving that the government and big businesses work either in favor or against each other, rumor or not, the future will speak for itself.

S&P Dow Jones Indices also claimed racial discrimination and poor working conditions at Tesla’s factory.

His reaction caused investors and traders to contemplate the future of TSLA in their portfolios.

What is the investors’ sentiment going forward?

Investors indicate another fall in Tesla’s stock and given the current price of $709,81, it is likely to go down up to $680 or even $620.

The main reason for this fall is Elon’s reaction to this unfortunate event.

But this might be a good opportunity for long-term investors, because Tesla will certainly go up in the future, considering Musk’s potential.

Conclusion

- It is no secret that the worldwide famous ‘Tech-king’ has a big influence on the stock market, which mainly involves Tesla and Twitter’s share price and investors cannot stay unbothered by the fact that two of the major stocks that are part of huge portfolios are not so stable as before.

- Tesla's stock might continue to drop.

- Tesla was kicked out of S&P 500 ESG Index based on accusations connected with racial discrimination and car crashes that its autopilot vehicles were involved.

LimitPrime © 2026

Categories

Leave comment

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More