Federal Reserve Rate-Hike Influence On The Dollar And Crude Oil

06.10.2022

During September, crude oil prices dropped to the lowest level since January with the US dollar rallying to record highs as central banks prepared for more interest-rate hikes.

The Federal Reserve — America’s central bank, has a huge part in keeping the economy on track. Its job is to keep inflation in order and help the job market to expand as much as possible.

By raising interest rates, the Federal Reserve hopes to rein in consumption and borrowing, which in turn should put downward pressure on prices. Or in simple terms, to lower the inflation rate, which during the month of September rose by 8.5% in the USA.

The Fed has the power to increase or decrease its benchmark rate, known as the federal funds rate, based on what exactly is going on in the economy. The federal funds rate has influence on how much banks and other financial institutions pay to borrow, and ripples down to businesses and households from there.

How exactly does the Federal Reserve control inflation?

Inflation often occurs in times of inconsistent supply and demand in one economy.

When there is not enough supplies for everyone, The Fed has to focus on slowing down demand instead. It wants fewer people to buy cars, houses, materials as given example, which would bring prices down.

When the Fed raises its benchmark interest rate, it makes all kinds of lending more expensive. Then after prices go up, that helps supply and demand to get back in sync.

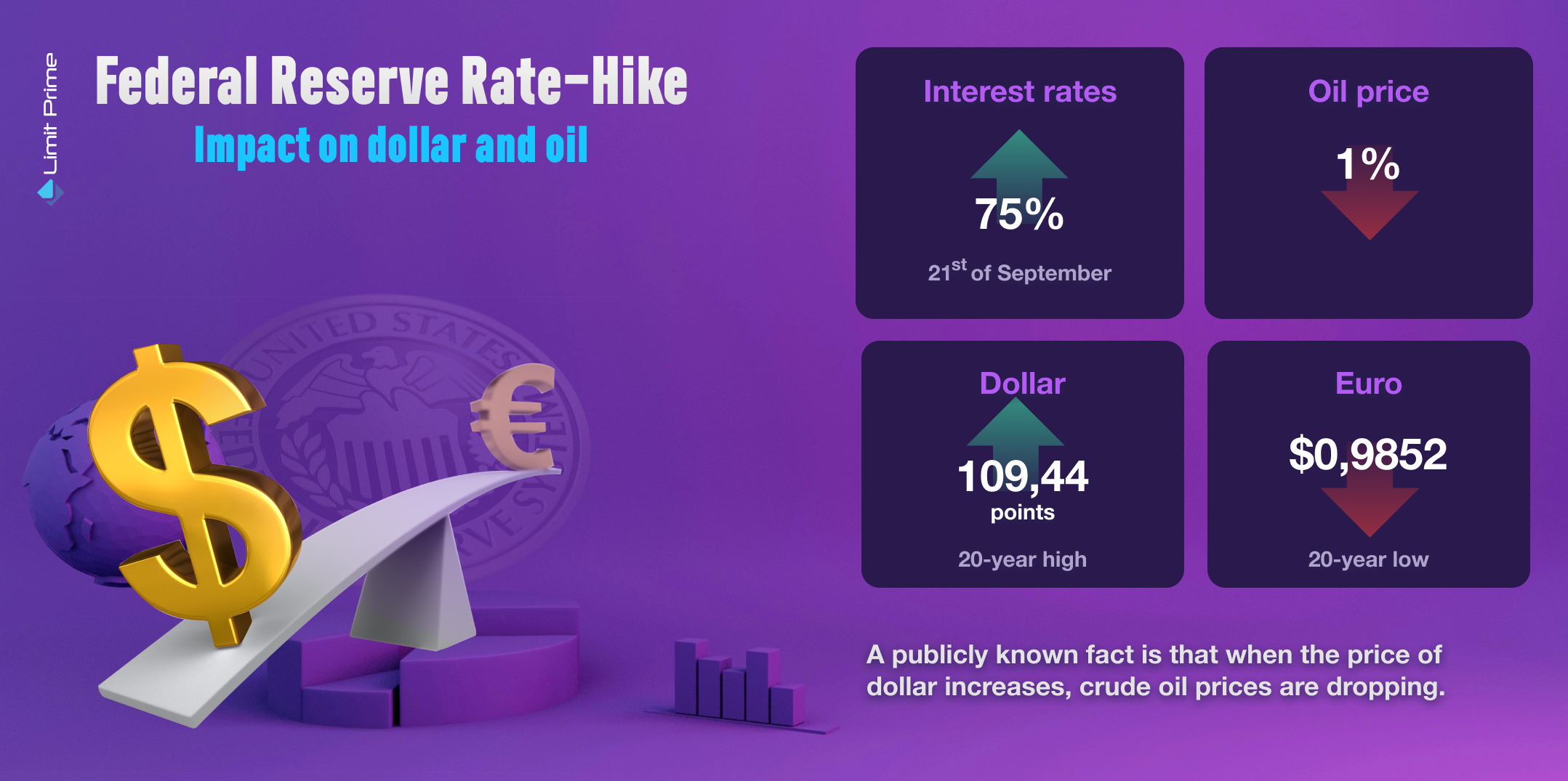

In addition to gaining control over the growing inflation, the fifth rate-hike of the year of 2022 happened on Wednesday, 21st of september. The interest rates were increased by 75 percentage points and Fed took its federal funds rate up to a range of 3%-3.25%. The highest it has been since early 2008.

Effect on the market

The inflation seems stuck at its high levels and it won’t be going down anytime soon, which indicates more rate-hikes in the future. Projections from the central bank’s meeting indicated participants expect to increase rates by at least 1.25 percentage points in the two remaining meetings this year.

“I believe 75 is the new 25 until something breaks, and nothing has broken yet,” Zox said from Brandywine Global. “The Fed is not anywhere close to a pause or a pivot. They are laser-focused on breaking inflation. A key question is what else might they break.”

It is true that the overall market is sensitive in times when the interest rates jump higher. The most recent rate-hike strongly affected the U.S. dollar and crude oil — one of the most traded commodities nowadays.

U.S. Dollar

Generally it’s known to all of us that higher interest rates indicate prosperity and growth of the value of a country's currency. Higher interest rates tend to attract foreign investment, increasing the demand for and value of the home country's currency. In this case it clearly means that the dollar is becoming stronger and the euro, on the other hand, is sinking deeper with every other rate-hike.

We are aware that the dollar is following a pattern of a 20-year high, gaining more than 16% on year-over-year bases; which doesn't seem to be coming to an end anytime soon.

The euro, the largest component in the dollar index, is going in the opposite direction, dropping to a 20-year low. The euro hit $0.9810 against the dollar. Europe's currency last changed hands at $0.9852, down 1.2%.

Against the yen, the dollar posted small gains compared to other major currencies, rising as high as 144.695 yen. The greenback last traded at 143.98 yen, up 0.2% on the day.

Traders remained wary of pushing the dollar higher given the threat of Japan intervention to boost the yen.

Crude Oil

A publicly known fact is that when the price of the dollar increases, crude oil prices are dropping.

Oil prices fell about 1% to a near two-week low in volatile trade on Wednesday after the U.S Federal Reserve delivered the news. This event could potentially reduce economic activity and demand for oil. Brent crude futures settled 79 cents, or 0.9%, lower at $89.83 a barrel, its lowest close since Sept. 8, while U.S. West Texas Intermediate (WTI) crude fell $1.00, or 1.2%, to $82.94, its lowest close since Sept. 7.

Earlier in the session on Wednesday, crude oil gained over $2 a barrel on the worries about a Russian troop mobilization. Some news that unexpectedly triggered the world: are the moments where the Russian President Vladimir Putin called up 300,000 reservists to fight in Ukraine and backed a plan to annex parts of the country, giving a hint that he was prepared to use nuclear weapons.

Oil prices soared to a multi-year high in March after the Ukraine war broke out. European Union sanctions banning seaborne imports of Russian crude will come into force on Dec. 5.

But the global demand for oil slumped in July, dropping by 1.1 million barrels a day in a period which usually sees oil usage creeping up, according to the Riyadh-based International Energy Forum.

China’s crude imports and use of oil in refineries fell year-on-year, according to data from the Joint Organizations Data Initiative.

The UAE’s national oil company is working on its plan to produce 5 million barrels of crude a day by 2025, which honestly is a shocking number.

Conclusion

The Federal Reserve is on a mission to keep fighting inflation. By increasing its interest rate, they discourage spending, which can reduce inflation of the prices for goods and services. Anyway, the downside to each rate hike is increased monthly debt costs for Americans. The latest rate increase was by .75 points.

The U.S. dollar is still one of the strongest currencies in the world, not working in favor of the euro. Besides, this crude oil is in a very volatile state.

The rate-hike will most likely continue, but you can profit from each change in the market. With CFD trading you can potentially gain a profit by speculating on the price movements. To find out more check out how to start trading with CFD & our Trading Conditions.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More