Important Market Events of 2022

21.12.2022

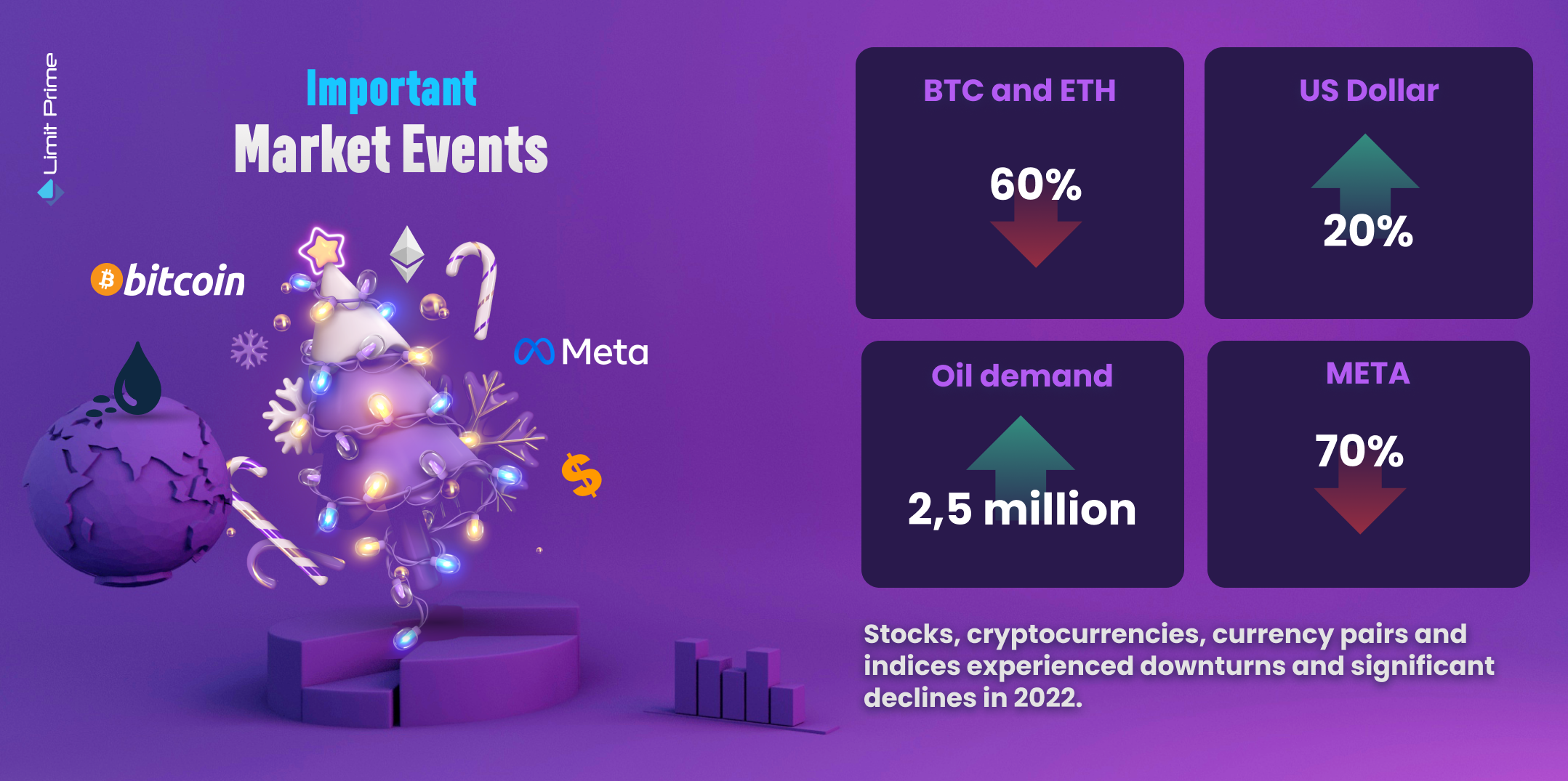

2022 was a dynamic year for everyone who is taking part in the capital markets. Tumultuous 2022 was marked by a historic bear market that affected almost every financial asset, and it finally came to an end. Stocks, cryptocurrencies, currency pairs, and indices all experienced downturns and significant declines. Speaking of the bear market it is important to note that the nature of this risk off-market is different from others in recent records. And that’s because of the Federal Reserve’s deliberate tightening of monetary policy, rather than focusing on a financial or economic crisis.

Why is this bear market one of a kind?

During crisis-fueled bear markets—such as the worldwide famous 2008 housing-related financial crisis and the 2020 pandemic-driven crash—a rapid easing of monetary policy was the antidote. This time, however, policy tightening (raising interest rates) was the cause of economic slowing, as central banks globally were forced to at least try to beat inflation. Historically looking, when this happens the bear market tends to be more prolonged.

If we slightly look past and focus on this particular bear market we can clearly see that the Energy sector was one of the few sectors that reported a good year. Another outperformer was the U.S. dollar (USD).

Regarding that, we packed an interesting recap of 2022 with the most popular events.

The collapse in the crypto world

Crypto’s total market capitalization peaked in November of 2021 as the Fed began hiking interest rates, and 2022 has been nothing short of disastrous for this asset class. The biggest crypto assets—Bitcoin and Ethereum—are down more than 60% in value on the year, and the high trading volumes that defined the speculative frenzy in 2021 are now nowhere to be seen. Not to mention the Celsius and FTX - two major crypto exchanges collapsed. And this is having devastating consequences across the crypto ecosystem.

June 12, it all came crashing down. Celsius posted a memo informing users that it had frozen their assets, sending the price of Bitcoin and other cryptos down along with it. A similar thing happened in early November, whispers began that FTX wouldn’t be able to back withdrawals for users. Over the course of the next week and a half, the value of FTT - the token dropped more than 90% as it became clear that FTX had lent user deposits to other ventures related to FTX founder and now-former CEO Sam Bankman-Fried and used FTT to backstop users' deposits.

Natural Gas

Natural gas and crude oil were able to be found in one basket this year. Both of these commodities have navigated a supply-and-demand situation very homogeneous to one another. Heightened demand, paired with stable supply, led to gains for the commodity in the early stages of this year. However, with the conflict in Ukraine and sanctions on Russia, shortages too, especially in Europe, led to skyrocketing prices in EU countries. EU countries tried to figure out how they were going to provide energy to their residents in the winter. The Nord Stream 2 pipeline shutdown early in the year and explosions in September also put further stress on other supplies.

U.S. Dollar (USD)

A breathtaking surge in the U.S. dollar trampled foreign currencies, contributed to corporate profits, and gave investors one of the year’s few winning trades. Though the growth of the dollar has stumbled recently, recession worries may keep it elevated in 2023. At its September peak, the dollar stood at its highest level in nearly two decades after rising some 20% against the British pound, Japanese yen, Euro, etc. Those year-to-date gains have been roughly cut in half as investors sense that the Federal Reserve is closer to slowing the rate increases that helped the dollar experience huge gains.

In 2022 the dollar was a famous destination during times of uncertainty and it was used as a safe “haven” from market volatility spurred by surging global inflation, crazy energy prices, and once again Russia’s invasion of Ukraine.

Meta Platforms (META)

Besides the rapid rate increases, this year’s stock market decline is an ongoing economic event, manifesting in other markets. Speaking of Meta the social media titan is down 73.7% year-to-date and nearly 80% from its 2021 high of $384. The dip of Meta was enough to overtake the S&P’s prior worst performer, Invisalign maker Align Technology, which is down 73.2% in 2022. Meta has had an uphill battle convincing the public that the metaverse really is the next huge thing. Investors haven’t taken this news well, dumping the stock and causing its price to fall to as low as $88 from more than $300 per share. Shocking.

Oil

The second quarter of this year was revised due to higher-than-expected oil demand in the major OECD-consuming countries. (The Organization for Economic Cooperation and Development) However, due to China's "zero COVID-19" policy, ongoing geopolitical uncertainties, and weaker economic activity, oil demand in the third and fourth quarters has been revised downward.

The Organization of Petroleum Exporting Countries (OPEC) revised down global oil demand growth by 0.1 million barrels per day (bpd) for 2022 and 2023, respectively, and estimated that demand would grow by 2.5 million and 2.2 million bpd, in 2022 and 2023.

Demand in the OECD is expected to rise by 0.3 million bpd next year, while demand in the non-OECD is expected to increase by 1.9 million bpd. Globally,total oil demand is now projected to average 101.8 million bpd in 2023.

Global oil supply increases

The global oil supply in October increased by around 0.7 million bpd compared to the previous month, averaging 101.5 million bpd. OPEC crude oil production averaged 29.49 million bpd in October, a month-on-month decrease of about 210,000 bpd. During this period, crude oil production in OPEC increased the most in Nigeria and Iraq, while production in Saudi Arabia and Angola declined.

Conclusion

Trading, investing, or just being present and watching what is happening in the capital market during the year was difficult for many. These negative and positive occurrences show that if you play your cards right you can potentially earn a good amount of profit.

The red zone of this year contained indices, stocks, and even cryptocurrencies, but on the green side were found: the energy sector and U.S. Dollar.

The strong side of CFD trading is that you can earn a profit regardless of the price movements, even if the market is declining. Click here to learn more.

LimitPrime © 2026

Categories

Leave comment

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More