Oil price drop - explained

24.03.2023

Black gold or known as crude oil is a natural resource that is extracted from the ground and refined into various products such as gasoline, diesel, and jet fuel. Also, crude oil is a commonly traded commodity in the financial markets and it serves as a financial instrument.

The prices of this commodity are influenced by a variety of factors such as global supply and demand, geopolitical events, and economic conditions. Because of this, crude oil is considered a volatile financial instrument, and its price can fluctuate rapidly and significantly.

Despite reaching its highest levels last year during this period, the price of crude oil recently experienced a drastic decline.

Why are crude prices so low?

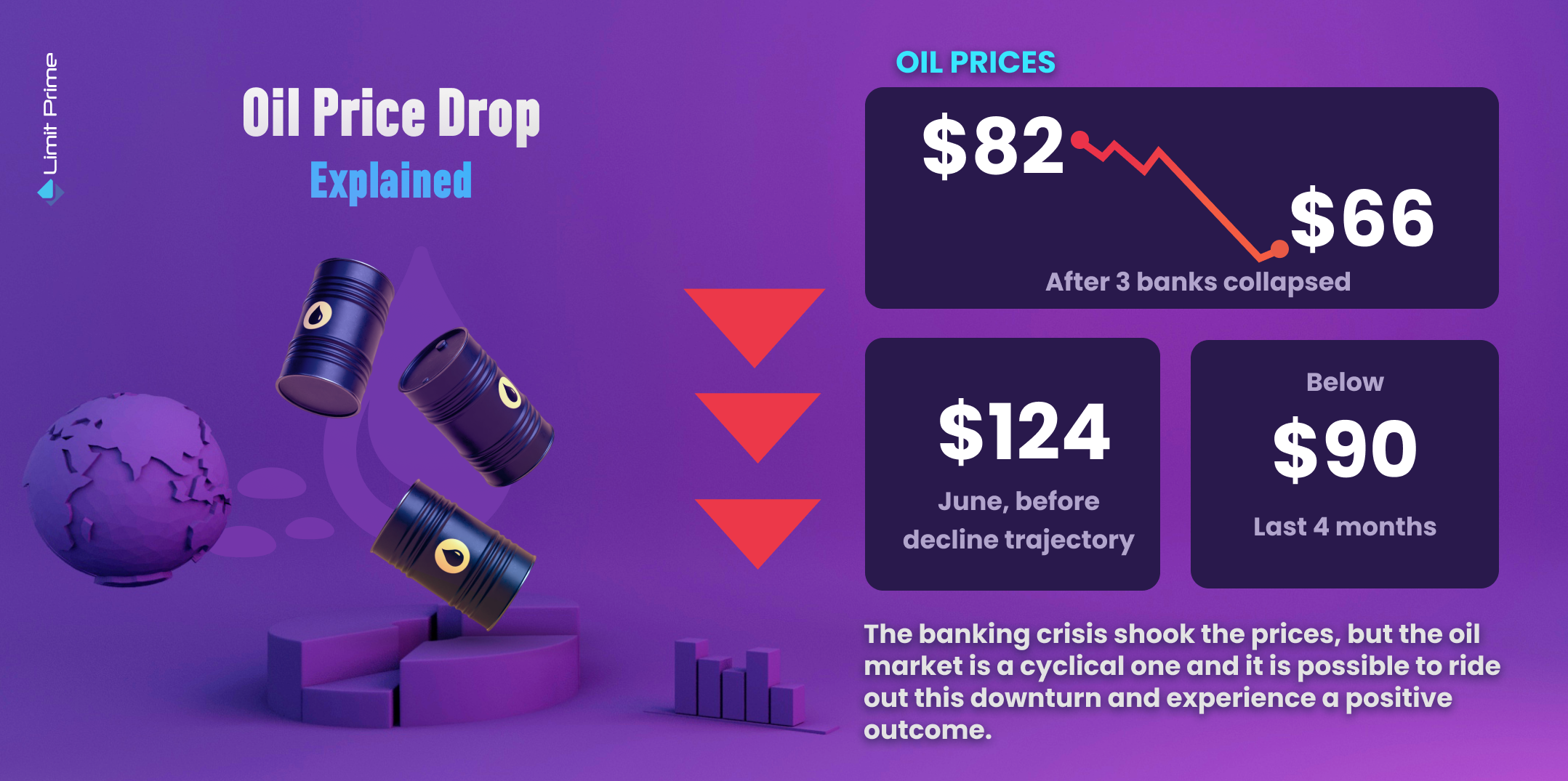

US crude oil prices neared $66, losing nearly $16 per barrel. This happened because of the banking crisis. Recently, three prominent banks in the United States - Silicon Valley, Silvergate, and Signature Bank - have been forced to shut down due to liquidity crises and business difficulties caused by the current financial and economic situation. The sudden collapse of these banks was caused by various factors such as the rapid increase in interest rates, the devaluation of their invested securities, and panic cash withdrawals that left regulators with no choice but to step in to protect depositors.

The collapse of Silicon Valley Bank triggered a snowball effect that contributed to the crash of Signature Bank and the closure of Silvergate by regulators. While clients of these banks are understandably concerned about the safety of their deposits, there is some good news. Silvergate has promised full repayment of all deposits, while Signature Bank's clients will be guaranteed their deposits by the Federal Deposit Insurance Corporation.

Although the collapse of these banks may have some impact on the local economy, it is unlikely to have a significant impact on the US financial system as a whole. The US banking system is heavily regulated and has safeguards in place to prevent systemic collapses.

The price of crude oil was not only determined by US banks, another factor that influenced the decline was the agreement in which Switzerland's largest bank, UBS, agreed to purchase Credit Suisse bank in an effort to save it from collapse.

Besides the collapse of the banks and new purchases, crude oil has been on a declining trajectory since last June when it reached $124 per barrel. For the last four months, prices have stayed below $90.

Fed’s decision influence on crude oil price

The Federal Reserve has increased interest rates by 0.25 percentage points, bringing the federal funds rate to a target range of 4.75 to 5.0 percent, following its March 21-22 meeting. This marks the ninth consecutive meeting in which the Federal Reserve has raised rates, as part of its ongoing efforts to reduce liquidity in the financial markets and fight against high inflation.

This rate hike triggered another drop in crude oil prices.

Can oil prices recover?

Not everything is as dark as it seems. The weakness of the dollar that is currently happening has helped to maintain some strength in oil prices. Despite other challenges, there may be potential for further increases in oil prices.

The possibility of a recovery in demand from China, the world's leading crude oil importer, could help to maintain support and bring a better future for oil prices. According to Goldman Sachs, there has been a significant increase in Chinese demand across a range of commodities, with daily oil demand reaching over 16 million barrels.

On the other hand, Russia will reduce oil production by 500,000 barrels during March. The International Energy Agency believes that Russia could reduce production by 1 to 2 million barrels per day to maintain the desired oil price.

Traders are becoming more optimistic about the recovery of fuel demand in China, believing that this will happen just as Russian oil exports begin to weaken in response to stronger sanctions due to the invasion of Ukraine.

According to an interview with Energy Intelligence on Tuesday last week, Saudi Arabia's energy minister, Prince Abdulaziz bin Salman, stated that the OPEC+ Alliance (a group of oil producers including OPEC and Russia) will maintain the production cuts agreed upon in October until the end of this year.

Crude oil price outlook

The US Energy Information Administration (EIA) revised its 2023 forecast in December regarding global crude oil prices, potentially expecting higher global oil inventories at the end of 2023.

For 2023, the agency expects the price of Brent crude to average $92.36 per barrel and WTI to average $86.36 per barrel.

The EIA said that global oil inventories are forecasted to fall by 0.2 million barrels per day (bpd) in the first half of 2023 before rising by almost 0.7 million bpd in the year's second half.

Will this really be the case? Well, every trader should be careful, because over the past few years, inflation has been higher than normal, and the Federal Reserve is taking significant steps to aggressively fight it by increasing interest rates, which has been affecting the capital market as a whole. As a result, it is important to have a trading strategy that works in order to benefit from the situation.

Conclusion

In conclusion, the banking crisis which was brought about by the collapse of three major banks and the rate increase has certainly had a significant impact on crude oil prices, causing them to drop to record lows.

However, with the global economy showing signs of recovery and the efforts of the major oil-producing countries to cut production levels, there is hope for a rise in oil prices. The key now is to remain present and carefully monitor market trends and most importantly make informed investment decisions. The banking crisis shook the market, but it is important to keep in mind that the oil market is a cyclical one, and with patience and smart planning, it is possible to ride out this downturn and experience a positive outcome.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More