SEC Strikes again: Binance and Coinbase lawsuits

14.06.2023

The two biggest crypto exchanges Coinbase and Binance are under attack! The United States Securities and

Exchange Commission (SEC) started a legal battle with these major names in the crypto-verse! Speaking of SEC, crypto enthusiasts are familiar with it because of the ongoing lawsuit between SEC and Ripple, Ripple is known for its digital payment protocol and Ripple cryptocurrency, read everything about the Ripple lawsuit here.

SEC lawsuits against Binance and Coinbase in depth

SEC has a clear history of going after the crypto industry during the past years, so on June 5, they filed a lawsuit against Binance for allegedly offering unregistered securities including Binance’s own digital assets such as BNB and the Binance USD (BUSD) stablecoin. However, only a day after filing the Binance lawsuit, the commission also went after Coinbase and placed similar claims, alleging that Coinbase traded at least 13 crypto assets that are securities and should have been registered, including well-known tokens such as Solana, Cardano, and Polygon. After the accusations, Coinbase suffered about $1.28 billion of net customer outflows following the lawsuit, according to initial estimates from data firm Nansen

The regulator as well pursued the companies for engaging in multiple roles, such as exchanges, brokers, dealers, and clearing agencies, without registering in any of those categories in the United States.

To support SEC’s claim, Collins Belton, an attorney who specializes in cryptocurrencies, stated in a tweet that "the SEC is alleging that Binance, like Trex, Beaxy, Coinbase, and every other crypto trading platform is essentially operating an unregistered exchange, but also provides clearing services and acts as a broker-dealer for its customers, and hasn't registered as any of those."

Why is SEC after Binance and Coinbase?

Binance and Coinbase are the most relevant names in the crypto scene. Binance is also the largest cryptocurrency exchange in the world, that has a daily trading volume of $11.5 billion. Since the disappearance of its US competitor, FTX, in the fall of 2022, which Binance outperformed through massive fund withdrawals, Binance has been under pressure from US politicians and targeted by US agencies, such as SEC.

In a defensive move after the collapse of FTX, Zhao - the co-founder and CEO of Binance, positioned himself as a spokesperson for the crypto world. He has been calling for increased transparency and security in the industry worldwide through the media. So far, nothing concrete has happened despite Zhao's announcements. To this day, Binance does not have an official headquarters, but the financial circumstances of the platform and its affiliated companies could be clearer.

Coinbase is a cryptocurrency exchange where you can buy popular coins like Bitcoin, Ethereum, and Solana. Not every coin is supported on Coinbase, but there are more than 120 different types of cryptocurrencies on the platform. With more than 8 million customers using the platform every month. Coinbase is known for its strong security measures and compliance with regulatory requirements, making it a trusted platform for individuals and institutions looking to engage in cryptocurrency transactions. Is that still the case, though?

Well, the SEC sent a Wells Notice to Coinbase earlier this year, threatening legal action against the exchange, Coinbase responded in April and now it escalated. A Wells Notice informs a company that the agency intends to take enforcement action against it.

According to data from the crypto information platform Nansen, Binance has already noticeably lost value. Coinbase shares dropped by 20%.

Possible impact on crypto trading

The lawsuits' outcomes are uncertain, but they could potentially result in a decrease in available funds for certain cryptocurrencies if the affected exchanges cannot facilitate trading, either temporarily or permanently. Trading cryptocurrencies has always involved speculation, but given the SEC's accusations, investors should reconsider whether they can afford to take such risks in their investment portfolios.

Additionally, it remains to be seen what will happen to the staking programs of both exchanges, as the SEC has connected the offering and sale of unregistered securities to staking. (Staking is when you lock crypto assets for a set period of time to help support the operation of a blockchain) As seen in a previous case, Kraken, a crypto exchange, agreed to terminate its staking program in the United States as part of a settlement with the SEC.

The actions taken against the two most influential figures in the crypto industry clearly demonstrate that US authorities are serious about regulating and legalizing the entire crypto market. However, it's about more than just the future of Binance and Coinbase. Personalities in the crypto scene like Anthony Scaramucci view the SEC's actions as a targeted attack on the end of digital assets in the US.

In addition to potential operational restrictions and loss of trust in Binance and Coinbase, the secondary effects could also shake the crypto industry. Keep in mind that the actions against Binance and Coinbase could be just the beginning of a broad US offensive against the crypto industry. In such an environment, a prolonged crypto winter could soon reemerge, following the recent surges in crypto markets.

A possible outcome of the lawsuit

Some analysts projected an outlook that indicates that if the SEC wins, both crypto exchanges will have to disappear from the US market.

“The question is whether this will make its way to court and if so, many in the crypto sector believe a judge will be more objective than the SEC in settling the question of whether cryptocurrencies are securities,” SEC legal expert Ron Geffner told CoinDesk.

“If the SEC wins, exchanges, issuers, and many service providers will have to revisit whether they want to continue to conduct business in the United States and if they do, they will need to determine whether and how best they can comply with the federal securities laws, both in connection with activity previously taken and future transactions.”

Effect on crypto prices

The lawsuits don’t appear to have bothered crypto investors much. But Bitcoin dropped sharply and is trading at around $25,900. On the other hand, Ethereum is traded at $1700.

Still, the SEC’s actions are “sending a loud and clear message to the public: ‘buyer beware,’” said Better Markets President Dennis Kelleher, whose advocacy group has called for more stringent regulations on the crypto industry.

Conclusion

The SEC lawsuits against Binance and Coinbase have shaken the crypto industry, emphasizing regulatory warnings and potential consequences. The outcomes are uncertain but have already impacted value and reputation. These actions highlight the need for transparency, compliance, and regulation.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

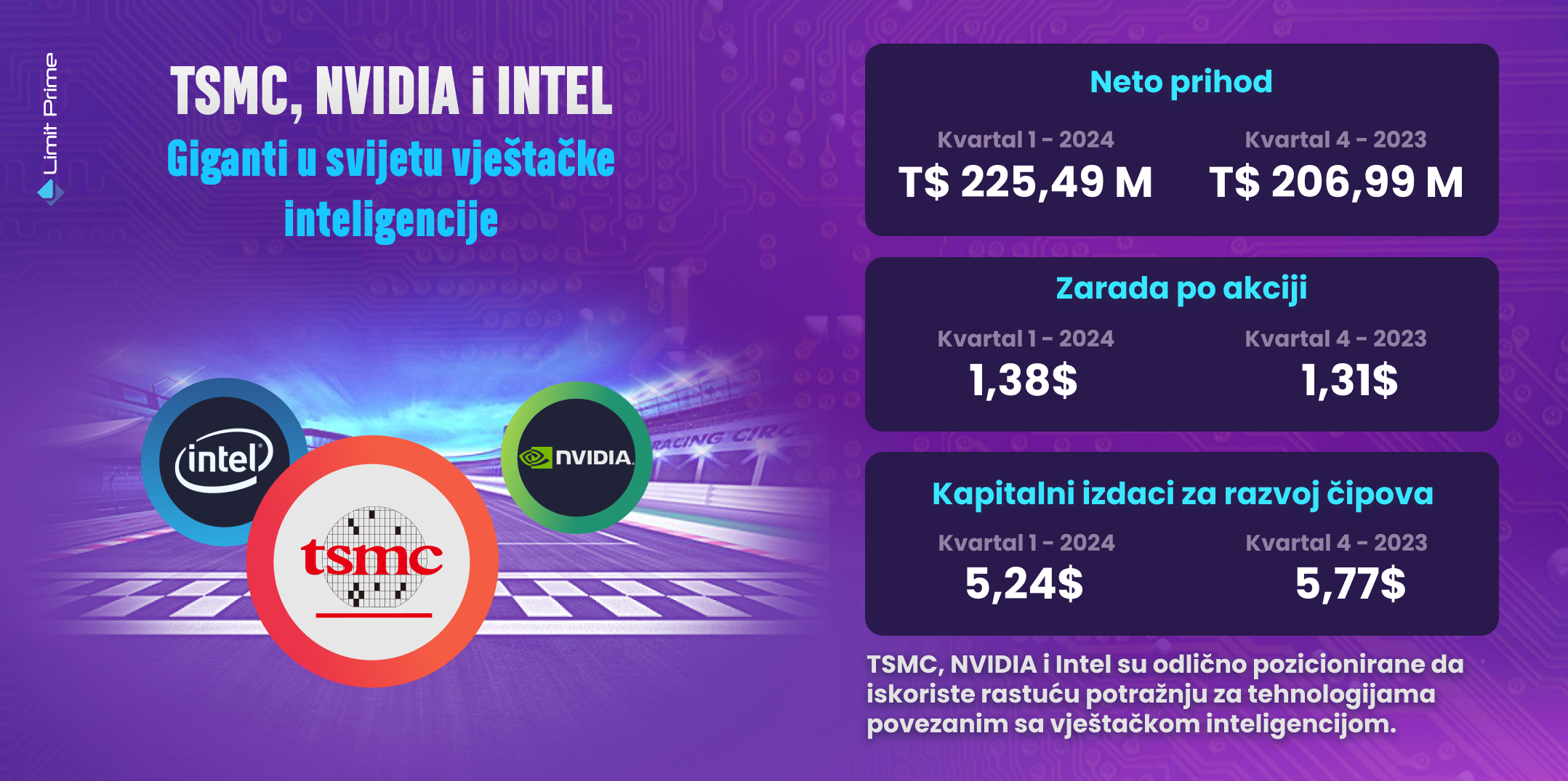

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More