Seesaw of stocks and stock indices - recession fears arising

02.10.2022

A year of sharp declines for the stock market reversed over the summer, giving stocks a much-needed rebound. But a bout of deep losses across the major stock indices in recent weeks has renewed fears of further decline.

Namely, in recent weeks, the stock market has soured, apparently over indication from the Federal Reserve that it intends to continue an aggressive series of borrowing cost hikes until it brings inflation under control — a policy approach that heightens the risk of tipping the U.S. economy into a recession.

Stocks started tumbling last Friday to cap a brutal week for financial markets, as surging interest rates and foreign currency turmoil heightened fears of a global recession.The S&P 500 on Tuesday closed at a lower point than it has on any other day of 2022. The Dow Jones Industrial Average, meanwhile, fell officially into bear market territory, meaning it had dropped at least 20% from its most recent peak.

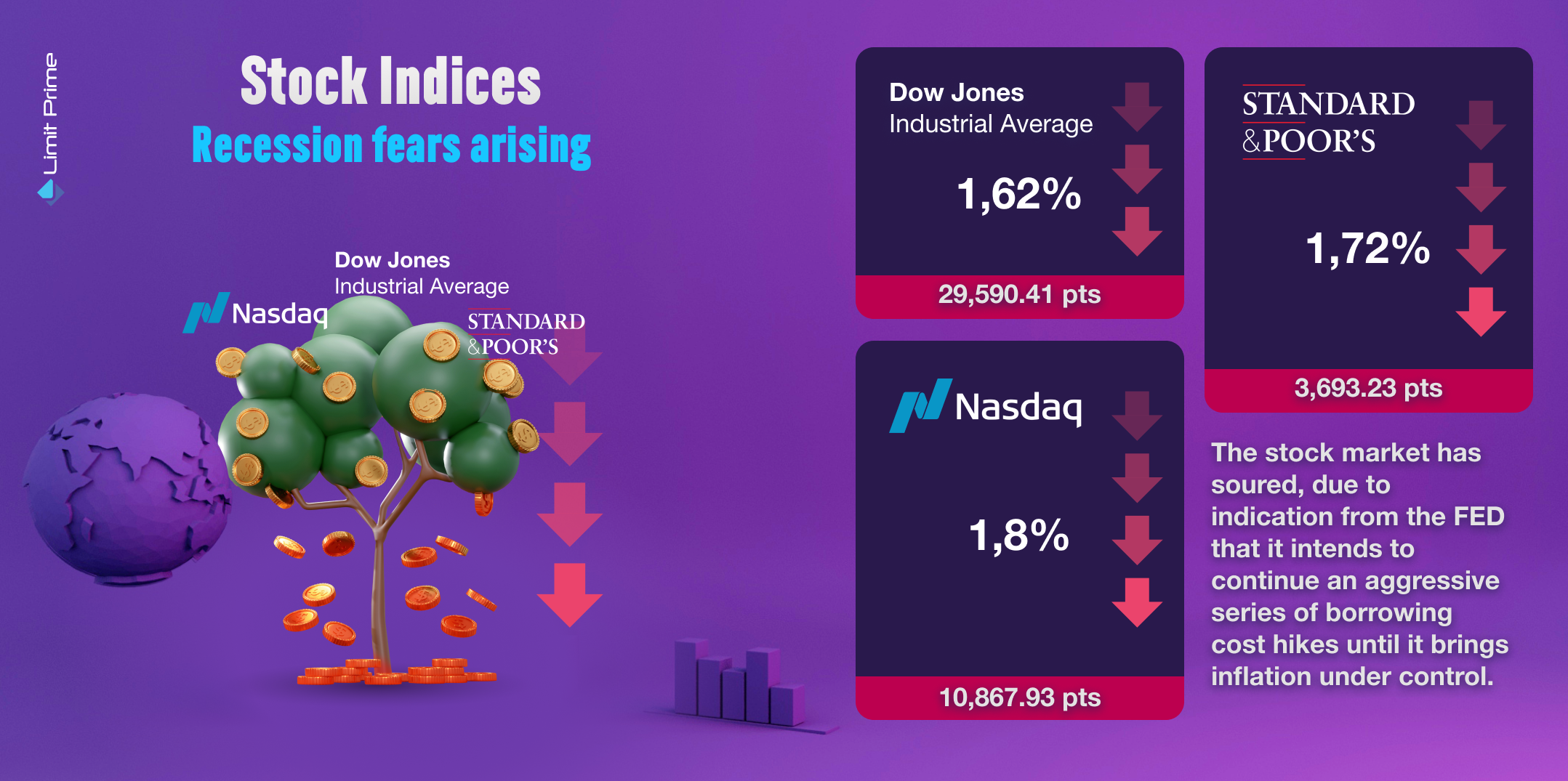

The Dow Jones Industrial Average tumbled 486.27 points, or 1.62%, to 29,590.41. The S&P 500

slid 1.72% from to 3,693.23, while the Nasdaq Composite dropped 1.8% to 10,867.93.

Before Wednesday, when they’ve started recovering, the Dow and S&P 500 were at their lowest levels since November 2020, both on a six-day losing streak.

The CBOE Volatility Index, also commonly known as Wall Street's fear gauge, tested 34.88 points, its highest level since June 13.

The recent drop marks the latest swing of this year's market seesaw. Bouncing back from a historic plunge over the first half of 2022, the S&P 500 rose more than 15% during a two-month period beginning in mid-June. Over that same period, the tech-heavy Nasdaq spiked more than 17% and the Dow rose nearly 14%.

In the previous session, Wall Street's main indexes sank deeper into a bear market, with the S&P 500 recording its lowest close in almost two years on rate hike worries.

If the U.S. falls into a recession, those losses could be even more pronounced.

Since 1950, the average decline for the S&P 500 during a recession is about 29%. So far this year, the S&P 500 has fallen nearly 24%.

It looks like the market is pricing a mild recession into stocks. As some experienced investors claim, classic early signs of recession are already here.

Why are stocks dropping?

Stocks are dropping because the Fed has put forward a string of aggressive interest rate hikes in recent months. Actually, for most part of this year, the Fed has held steadfast to its goal of a soft landing for inflation, the idea of vanquishing inflation without a dramatic economic downturn.

The policy approach aims to slash price increases by slowing the economy and choking off demand. But this move risks tipping the U.S. into a recession and putting millions out of work.

A recession poses a serious threat to the stock market because it could dramatically cut corporate profits, the key focus for stock forecasters. As workers lose their jobs and consumers cut back on spending, business gains dry up.

The main reason stocks remain vulnerable in recessionary environments is that corporate profitability is affected. That makes prevailing stock prices harder to justify if corporate profitability is sinking.

Typically, the market has climbed back up now in response to news about slowing inflation and a potential softening of rate increases; inflation spikes and rate moves are a common cause of selloffs.

Inflation data released earlier this month revealed that prices rose unexpectedly in August, sending the market tumbling. Last week, the Federal Reserve instituted a 0.75% rate hike, which sent stocks falling even further.

How far will the stock market fall?

It's difficult to predict the specific length of a market slide. But history suggests the downturn could last for several more months and possibly more than a year and that stock prices may fall even further.

The rate hikes instituted by the Fed would weigh on the economy for at least 6 to 12 months and potentially even longer.

Even if the Fed changes course, the rate increases they've just done this year haven't had their full impact. With that backdrop, analysts think it will continue to be a volatile market and the economy will be weakened.

What should investors do in this situation?

With stocks falling into a bear market this year amid fears that aggressive rate hikes from the Federal Reserve will plunge the economy into a looming recession, top firms on Wall Street are advising investors to stick with stocks that have historically performed well during past downturns, such as consumer and healthcare companies.

An optimal strategy for buying stocks may be to examine the characteristics of stocks that tend to perform better than others during a recession, and use this information to build a portfolio that’s ready for anything — recessions and all.

One way to use sector segmentation to your advantage is to tactically align your portfolio to include exchange-traded funds and index funds that track sectors that have historically outperformed during down periods, so you're ready for anything the market brings.

Major Wall Street firms are now advising clients to ride out the downturn by buying defensive stocks with stable margins, steady cash flow and solid dividends, especially in sectors like utilities, health care and consumer food staples.

Why these three sectors? Particularly, during typical recessions, consumers tend to pull back spending on discretionary or luxury purchases, things such as entertainment and dining out, but they’ll continue purchasing items they may need every day — think food, beverages, household and personal products, tobacco and similar items. The companies that supply these products are in the consumer staples sector. Regardless of the recession, consumers still have to spend money on health care, they still have to pay their utilities, and they still have to eat. Also historically, these stocks have fared well during recessions. In the last four recessions since 1990, consumer and healthcare stocks were the only two positive sectors in the S&P 500.

Health-care stocks tend to be safer during recessions for the same reason as consumer staples - The services and products they offer are always in demand. This sector includes companies in the biotech, pharmaceutical and health care equipment industries, as well as health care providers and services.

Moving some of your investments into defensive stocks is a smart move when a recession is looming. Keeping an eye on economic indicators like GDP will help you know when to get in and out of certain positions.

Experts are increasingly warning that a recession looks “inevitable” as the Federal Reserve scrambles to combat surging inflation by raising interest rates at the fastest pace in 28 years, with a 75-basis-point increase announced earlier this week.

However, there is no perfect recession-proof stock. This brings us to the real recession-hedge: diversification. These are all things to take into consideration, when positioning onto the stock and indices market.

LimitPrime © 2026

Categories

Leave comment

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More