History Of Trading

The financial and monetary system as we know it today has evolved in the last decades.

Trading was the main facility of prehistoric people, who bartered goods and services from each other before the innovation of modern-day currency.

Let’s dive in and see how it all started.

Barter system & the metal age

The oldest method of exchange, the barter system, started in 6 000 BC, initiated by Phoenicians (Mesopotamia). The barter system implied the exchange of goods.

Then the system improved, salt and spices were popular items to exchange - even Roman soldiers were paid with it. While in the Middle Ages, crafts, furs, silks and perfumes became much more popular. With the advent of money, bartering didn’t end, it just became more organized.

The interesting fact is that during the Great Depression (the 1930s) bartering came back to trend. Due to a lack of money, people were exchanging goods (mostly food) and services.

The Metal Ages are the period when the first coins were produced and acted as a currency. Coins were set as an official currency because of their features like: portability, durability, divisibility, uniformity, limited supply and acceptability. Silver and gold became the standard of trading.

The Gold Standard

Soon, gold took over the role of silver as well and became the only currency for trading. However, with time, people realized that gold was pretty heavy to carry and thus inconvenient for daily use.

The gold standard monetary system was adopted worldwide in 1875. This meant that the government of a certain country would redeem any amount of paper money for its value in gold. The value of one ounce of gold was being standardized.

Countries traded with each other because they could easily convert foreign currencies into gold.

The Bretton Woods Agreement

The gold standard couldn’t withstand the world wars - there was not enough gold in the reserves to pay off the debts.

The delegates from 44 countries met in 1944 in Bretton Woods, New Hampshire, U.S.A. to design an environment in which global economies could be stabilized. The US dollar was a basic currency by which most other currencies were compared at that time.

Considering this US dollar’s great advantage, leaders at this event agreed that foreign countries will fix their exchange rate to the US dollar. The US dollar was also pegged to gold, as the primary reserve currency, because the U.S.A. held most of the gold reserves.

With the progress of trades and the government's increasing transactions, the amount of US dollars in the system also increased. At some point, there was not enough gold to back up the amount of money in circulation.

The Bretton Woods Accord ended in 1971, due to the lack of gold in reserves. The free-floating system was established two years later. Finally, the US dollar floated freely against the other foreign currencies.

The Plaza Accord

The US dollar was the strongest currency at that moment and in a free-floating system, it was appreciating. That led to a crisis for the U.S.A. industry because U.S.A. manufacturers couldn’t compete with competitors due to such high prices.

The Plaza Accord was signed in 1985. The leaders from the most powerful economies (U.S.A, UK, France, Germany and Japan, known as G-5) met at hotel Plaza in New York and agreed to depreciate the US dollar by encouraging appreciation of other currencies. The end goal was to reduce the trade imbalance between the U.S.A. and Germany, and the U.S.A. and Japan.

This agreement ended successfully and the US dollar depreciated approximately 50% against the Yen and the Deutsche Mark. The second agreement, named Louvre Accord was signed in 1987 to stop declining the US dollar.

The 1985 "Plaza Accord". From the left are Gerhard Stoltenberg, Pierre Bérégovoy, James A. Baker III, Nigel Lawson and Noboru Takeshita.

The 1985 "Plaza Accord". From the left are Gerhard Stoltenberg, Pierre Bérégovoy, James A. Baker III, Nigel Lawson and Noboru Takeshita.

The Maastricht Treaty - establishment of the euro

The most prolific agreement signed after World War II was the Maastricht Treaty in 1992. It was designed to bring countries of Europe closer together. The conference was held in Maastricht (Netherlands) and led to the creation of the European Union and the Euro currency.

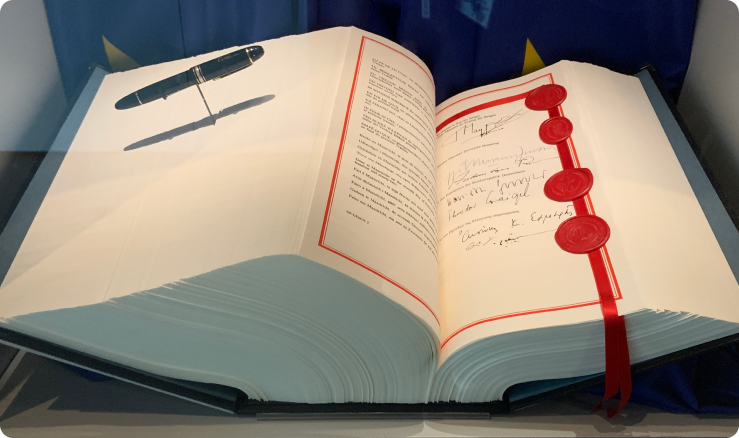

By creating the Euro, European countries (especially banks and businesses) benefitted from being independent of the US dollar by removing the exchange risk. Of the initial 12, today there are 27 countries in the EU and the Euro has become the world’s second most traded currency. The Treaty of Maastricht, here shown at an exhibition in Regensburg. The book is opened at a page containing the signatures and seals of the ministers representing the heads of state of Belgium, Denmark, Germany and Greece.

The Treaty of Maastricht, here shown at an exhibition in Regensburg. The book is opened at a page containing the signatures and seals of the ministers representing the heads of state of Belgium, Denmark, Germany and Greece.

Modern foreign exchange

The first currency pairs were traded in 1982 by retail customers. By the end of the 1980s, the UK and the U.S. had the highest proportion of trades, respectively.The introduction of the Internet (in the 1990s) brought various changes in people's lives, including the way of trading and earning. People started to be more interested in the currency market and it started growing faster than ever since it was more convenient to use. This major change caused the flourishing of the emerging markets and eventually, all world’s currencies could be traded.

Using the Internet, an investor can have access to all essential information, open an account on the trading platform as well as trade securely at any time from any part of the world. We can freely say that this was a crucial historical moment for the progress of the foreign exchange market.

Conclusion

Trading has existed, pretty much, since the existence of man. Not in the way we know it today, but it evolved through various events.Getting familiar with how the history of the foreign exchange developed could help you understand today’s situations in the financial world (e.g. why the US dollar is the world’s reserve currency).

With the coming of the digital area, where electronic communication networks are used worldwide, it became much easier to trade as well. Series of advancements in technology affected the trading industry and foreign exchange became more appealing.

In the last decade, the foreign exchange market has gained popularity and growth, and there’s no sign of it going back. All investors who want to succeed in this volatile financial market need to constantly educate themselves in order to predict market movements accurately.

Sources Consulted:

1. Bradfield, D. The history of forex. https://www.dailyfx.com/education/beginner/history-of-forex.html

2. Patterson, S. The history of forex trading. DailyForex https://www.dailyforex.com/forex-articles/2008/04/the-history-of-forex-trading/66 (2008)

3. Morratt, B. Forex trading history - how Forex trading started. https://www.expertinvestor.net/forex/guides/history/ (2020)

4. FP Markets Team. A Brief History of Forex. FXStreet https://www.fxstreet.com/education/a-brief-history-of-forex-201910310924 (2019)

5. Iron Age: Coins & Currency. https://study.com/academy/lesson/iron-age-coins-currency.html

6. Lioudis, N. What is the gold standard? https://www.investopedia.com/ask/answers/09/gold-standard.asp (2020)

7. European Central Bank. Five things you need to know about the Maastricht Treaty. https://www.ecb.europa.eu/explainers/tell-me-more/html/25_years_maastricht.en.html (2020)

LimitPrime © 2026

Begin to invest and

start earning today!

Categories

Do you need personalized assistance?

READ MORE INTERESTING ARTICLES

Diversificationnoun the action of diversifying something or the fact of becoming more diverse. a trading strategy that reduces risk. D...

Read More

As any risk disclosure will tell you, trading financial instruments put the trader at risk of losing some or all of their allocated cap...

Read More

What are indices?Indices measure the performance of a group of stocks, bonds or other investments. These investments are often grouped...

Read More