Alibaba 2021 forecast

26.03.2021

China’s Alibaba is a multinational technology company specialized in e-commerce, retail, Internet, and technology. In 2020, Alibaba was rated as the fifth-largest artificial intelligence company and one of the biggest investment corporations in the world.

Alibaba is sometimes called “Chinese Amazon” due to its similar business models, which include an online retail marketplace, a cloud business and a fintech e-payments business called ANT Group.

Alibaba stock has been one of the biggest winners on the stock market since its initial public offering in September 2014. In spite of a slowdown in its core e-commerce business, this market giant stock managed to grow and become one of the top stocks to buy for 2️021.

Alibaba stock sold off on December 24 after the news that the Chinese government is launching an anti-monopoly probe into this e-commerce company. But the stock recovered fast on December 29 over the news about overtaking the operations of Ant Group.

Alibaba’s revenues have more than tripled in the last three years.

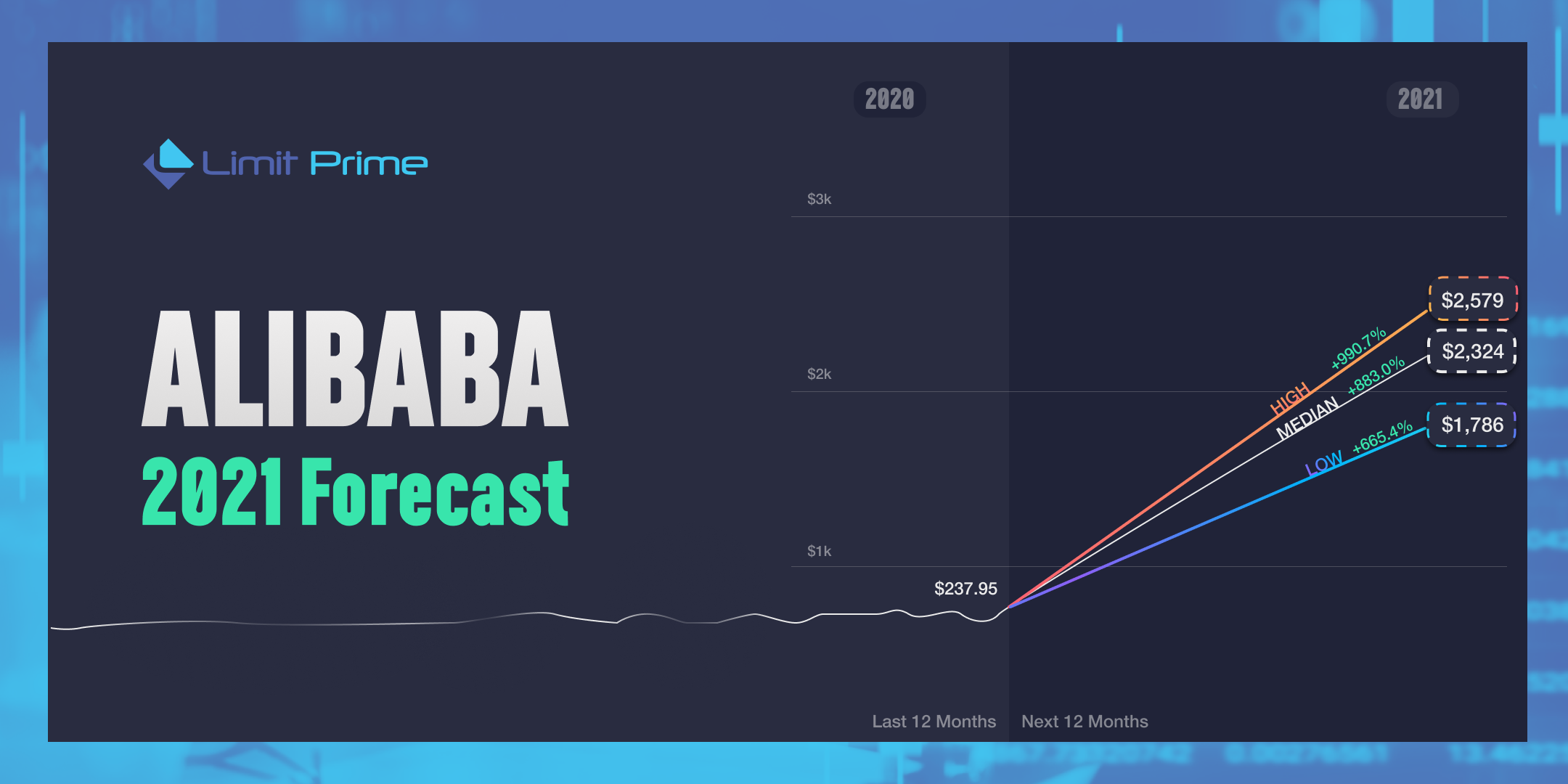

As you can see on the infographic, price forecasts for Alibaba have a median target of $2,324.00, with a high estimate of $2,578.77 and a low estimate of $1,785.89. The median estimate represents a +882.95% increase from the last price of $236.43.

On the other hand, Alibaba is still under investigation by Chinese regulators, due to its founder Jack Ma giving a speech in which he criticized Chinese regulators and the banking industry. This caused quite a stir on the market. However, China has too much to lose by letting this company fail. This would have huge repercussions for its economy so a compromise as the solution to the conflict is to be expected.

Alibaba is sometimes called “Chinese Amazon” due to its similar business models, which include an online retail marketplace, a cloud business and a fintech e-payments business called ANT Group.

Alibaba stock has been one of the biggest winners on the stock market since its initial public offering in September 2014. In spite of a slowdown in its core e-commerce business, this market giant stock managed to grow and become one of the top stocks to buy for 2️021.

Alibaba stock sold off on December 24 after the news that the Chinese government is launching an anti-monopoly probe into this e-commerce company. But the stock recovered fast on December 29 over the news about overtaking the operations of Ant Group.

Earning, Sales and Revenue during the Covid-19 Pandemic

Alibaba continues to grow. However, earnings and sales growth slowed dramatically in May due to the Covid-19 pandemic. Adjusted profit rose 2% year over year to $1.30 a share. Revenue increased 16% to over $16.14 billion, above expectations of $15.1 billion.Alibaba’s revenues have more than tripled in the last three years.

As you can see on the infographic, price forecasts for Alibaba have a median target of $2,324.00, with a high estimate of $2,578.77 and a low estimate of $1,785.89. The median estimate represents a +882.95% increase from the last price of $236.43.

On the other hand, Alibaba is still under investigation by Chinese regulators, due to its founder Jack Ma giving a speech in which he criticized Chinese regulators and the banking industry. This caused quite a stir on the market. However, China has too much to lose by letting this company fail. This would have huge repercussions for its economy so a compromise as the solution to the conflict is to be expected.

LimitPrime © 2026

Categories

Buy and sell stocks with ease.

Leave comment

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More