Brent Crude Three-Year Peak

01.10.2021

Oil prices made a drastic drop at the start of the Covid 19 pandemic. In April of 2020, they fell below zero for the first time in history as lockdown wiped out demand while producers continued to pump crude from their wells.

But as the pandemic is being suppressed and countries around the globe begin to reopen their borders, the oil demand has started to rise, and along with it, its prices as well. Oil manufacturers, producers and distributors have been waiting for this moment for a long time.

Another circumstance that affected the oil market was Hurricane Katrine. Global oil supplies have also taken a hit from hurricanes passing through the Gulf of Mexico and damaging US oil infrastructure. This circumstance directly caused the fall of the oil supply that triggered the oil prices to go up.

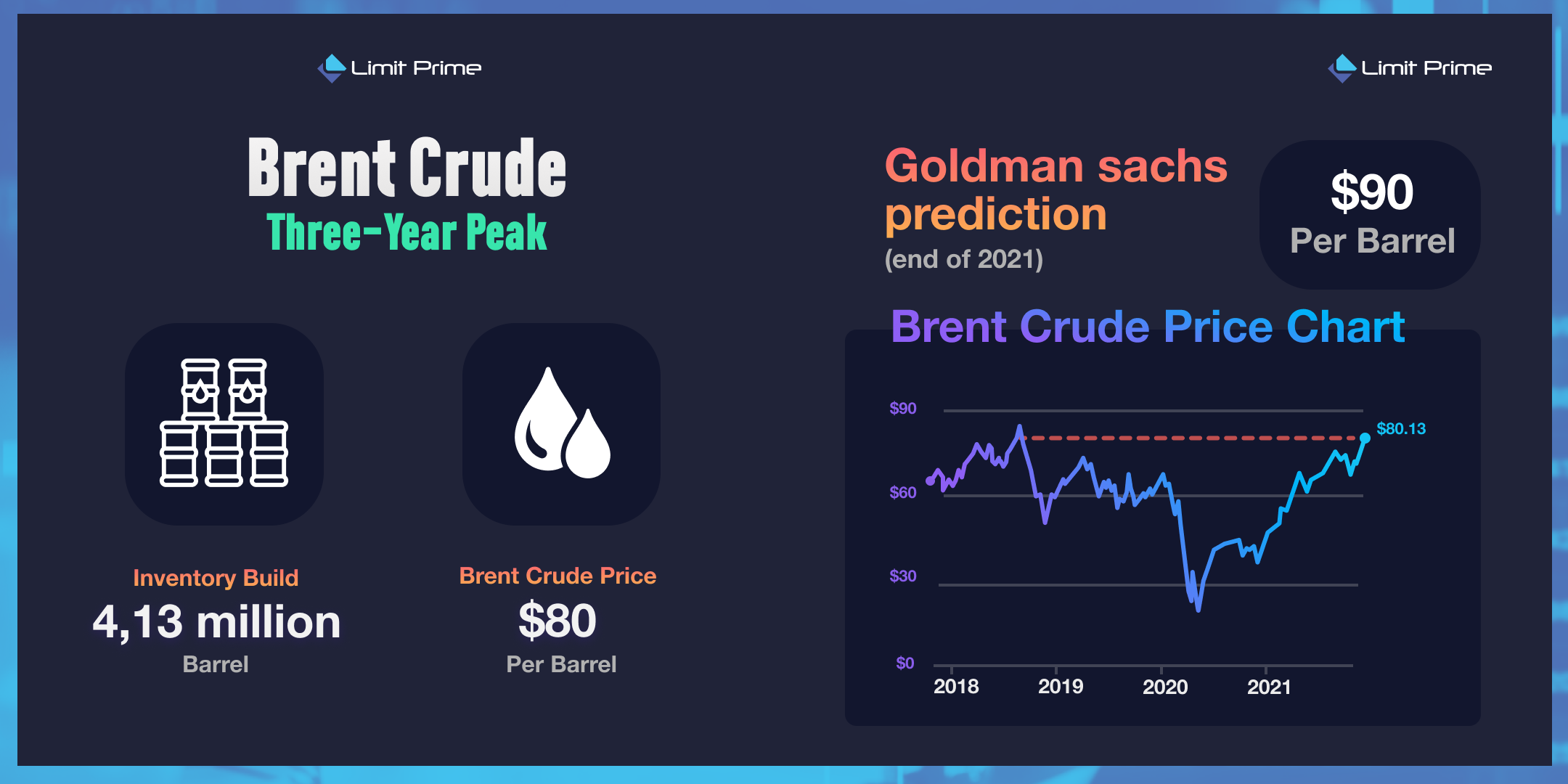

All of the above led to a large increase in the black gold price. As you can see from our infographic, Brent crude prices rose above $80 a barrel on September 28, hitting their highest level in three years. The rally was initiated on gas and coal supply worries due to the northern hemisphere winter when demand is at its highest.

However, recently Brent crude slipped below $80 a barrel. The main reason being traders deciding to take profits on the latest bull run. We can’t blame them. However, according to experts, this fall is just a short trend and they believe that the oil prices will continue to rise amid rising demand and tight supplies. We found this assumption logical and pretty much promising due to the remission of pandemic restrictions.

Goldman Sachs has made a prediction of a $10 price increase until the end of 2021. Its year-end forecast for Brent crude is $90 per barrel.

But as the pandemic is being suppressed and countries around the globe begin to reopen their borders, the oil demand has started to rise, and along with it, its prices as well. Oil manufacturers, producers and distributors have been waiting for this moment for a long time.

Another circumstance that affected the oil market was Hurricane Katrine. Global oil supplies have also taken a hit from hurricanes passing through the Gulf of Mexico and damaging US oil infrastructure. This circumstance directly caused the fall of the oil supply that triggered the oil prices to go up.

All of the above led to a large increase in the black gold price. As you can see from our infographic, Brent crude prices rose above $80 a barrel on September 28, hitting their highest level in three years. The rally was initiated on gas and coal supply worries due to the northern hemisphere winter when demand is at its highest.

However, recently Brent crude slipped below $80 a barrel. The main reason being traders deciding to take profits on the latest bull run. We can’t blame them. However, according to experts, this fall is just a short trend and they believe that the oil prices will continue to rise amid rising demand and tight supplies. We found this assumption logical and pretty much promising due to the remission of pandemic restrictions.

Goldman Sachs has made a prediction of a $10 price increase until the end of 2021. Its year-end forecast for Brent crude is $90 per barrel.

LimitPrime © 2026

Categories

Leave comment

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More