Is inflation going out of control?

10.06.2021

As the Covid-19 chapter is slowly coming to a close in the developed world, the cost of dealing with the economic consequences of the pandemic are starting to show. One of those costs is the risk of growing inflation.

One risk of higher inflation is that it has a regressive effect on lower-income families and older vulnerable citizens who might be living on a fixed income. If prices are rising faster than wages, then there will be a steep decline in real incomes.

High inflation may also lead to higher borrowing costs for businesses and people needing loans and mortgages as financial markets seek to protect themselves against rising prices and increase the cost of borrowing on short and longer-term debt.

Of course, a certain level of inflation isn’t necessarily bad. A slow and steady increase in price levels is believed to keep businesses profitable and prevent consumers from waiting for lower prices before making purchases.

However, excessive money printing, especially in the US, has led to a growing concern that inflation levels could get out of hand which would have devastating effects on the economies around the world.

If inflation remains high, the Fed probably won’t have much of a choice other than to gain control over it by raising interest rates. Interest rates can greatly influence the USD exchange rates against other currencies.

While it’s possible that this increase in interest rates might go over well, history hasn’t shown a positive outlook at such a turn of events. Every time the Fed has hit the brakes hard enough to slow growth meaningfully, the economy has gone into recession.

However, with stimulus packages winding down and things getting back on track as the pandemic nears its end in the developed world, we’re hoping to see inflation rates return to normal so we can avoid this bleak scenario.

One risk of higher inflation is that it has a regressive effect on lower-income families and older vulnerable citizens who might be living on a fixed income. If prices are rising faster than wages, then there will be a steep decline in real incomes.

High inflation may also lead to higher borrowing costs for businesses and people needing loans and mortgages as financial markets seek to protect themselves against rising prices and increase the cost of borrowing on short and longer-term debt.

Of course, a certain level of inflation isn’t necessarily bad. A slow and steady increase in price levels is believed to keep businesses profitable and prevent consumers from waiting for lower prices before making purchases.

However, excessive money printing, especially in the US, has led to a growing concern that inflation levels could get out of hand which would have devastating effects on the economies around the world.

Can The Fed Control the Inflation Now?

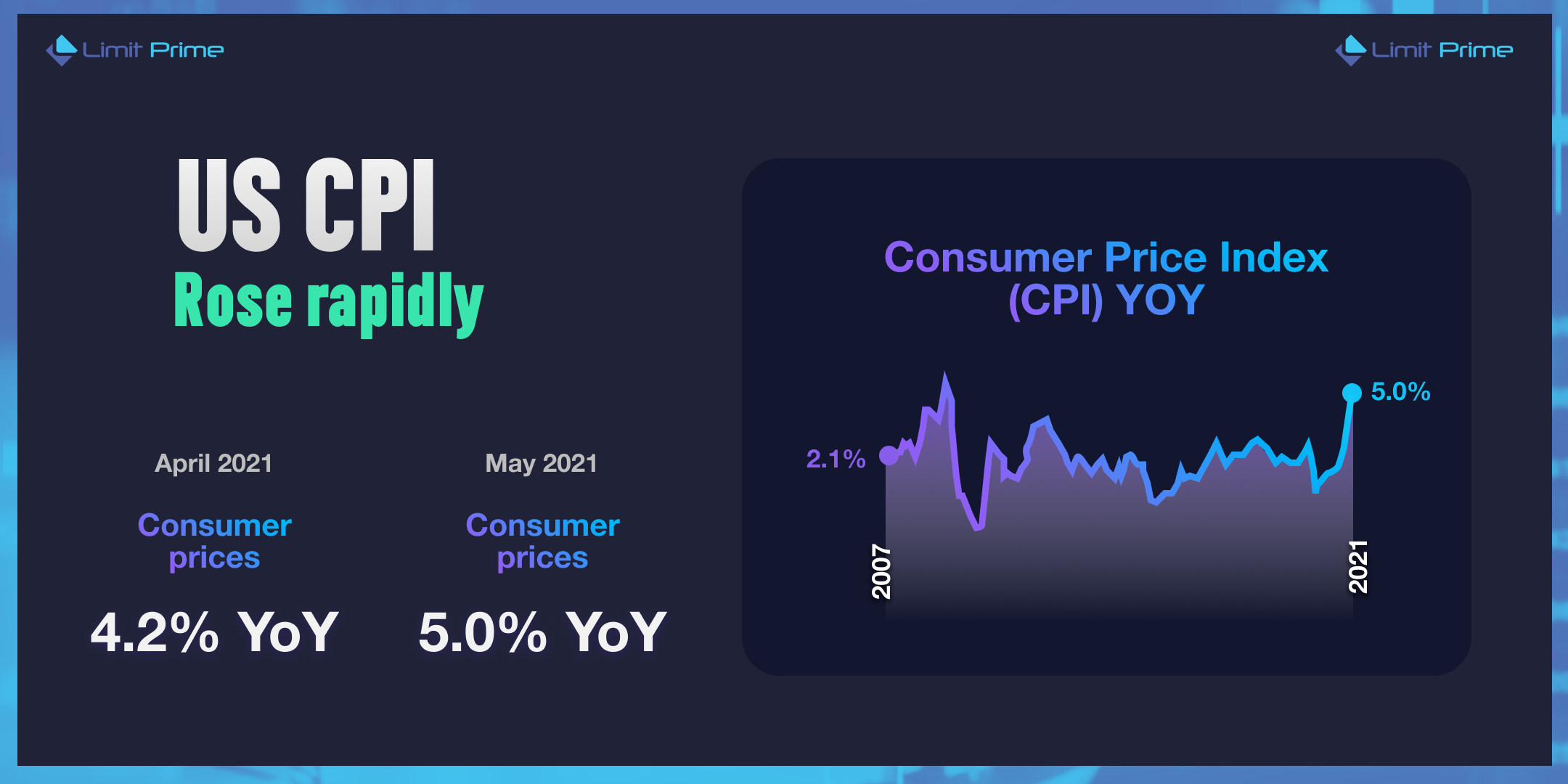

In April, consumer prices in the US have increased by 4.2% YoY, with prices going up another 0.8% in May. Already, consumer prices have risen almost as much as the Federal Reserve has predicted for the whole year.If inflation remains high, the Fed probably won’t have much of a choice other than to gain control over it by raising interest rates. Interest rates can greatly influence the USD exchange rates against other currencies.

While it’s possible that this increase in interest rates might go over well, history hasn’t shown a positive outlook at such a turn of events. Every time the Fed has hit the brakes hard enough to slow growth meaningfully, the economy has gone into recession.

However, with stimulus packages winding down and things getting back on track as the pandemic nears its end in the developed world, we’re hoping to see inflation rates return to normal so we can avoid this bleak scenario.

LimitPrime © 2026

Categories

Buy and sell indices with ease.

Leave comment

Comments

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More