Oil Prices at a 10-month-high

08.09.2023

The year 2023 was a turbulent chapter in the history of global energy markets. From the heights of optimism to the depths of uncertainty, this year tested the resilience of economies, shaped geopolitical dynamics, and underscored the ever-volatile nature of the oil industry.

As the world began to recover from the far-reaching effects of the COVID-19 pandemic, the year started with a sense of hope and renewed economic activity. Oil prices surged in response to resurging demand, reflecting the world's eagerness to return to pre-pandemic levels. However, the path ahead was anything but straightforward.

In this article, we will take you on a journey through the dramatic ups and downs that defined the oil market in 2023.

What’s driving oil prices in 2023?

In early April, OPEC+ took the market by surprise with an unexpected announcement of a substantial cut in oil production, amounting to approximately 1.6 million barrels per day. This move, which came as a shock to many, was projected by Reuters to result in a cumulative reduction of 3.6 million barrels per day (3.7% of total demand) when considering the combined efforts of OPEC, Russia, and their allies.

This surprising decision had multiple driving factors. Firstly, it was motivated by concerns over a potential global economic downturn, with OPEC+ aiming to stabilize oil prices by curbing supply.

By June 2023, oil prices had dipped at least $50 per barrel compared to the previous year's period. This downward trend was primarily influenced by a shift in market sentiment. Initially, there were worries about a shortage of supply in the face of rapidly increasing demand. However, as time progressed, concerns shifted towards weaker demand and an excess of supply. In June, Goldman Sachs revised its 2023 price projection to $86 per barrel.

But currently, we are experiencing a price increase in the oil markets.

What caused oil prices to settle at a 10-month-high?

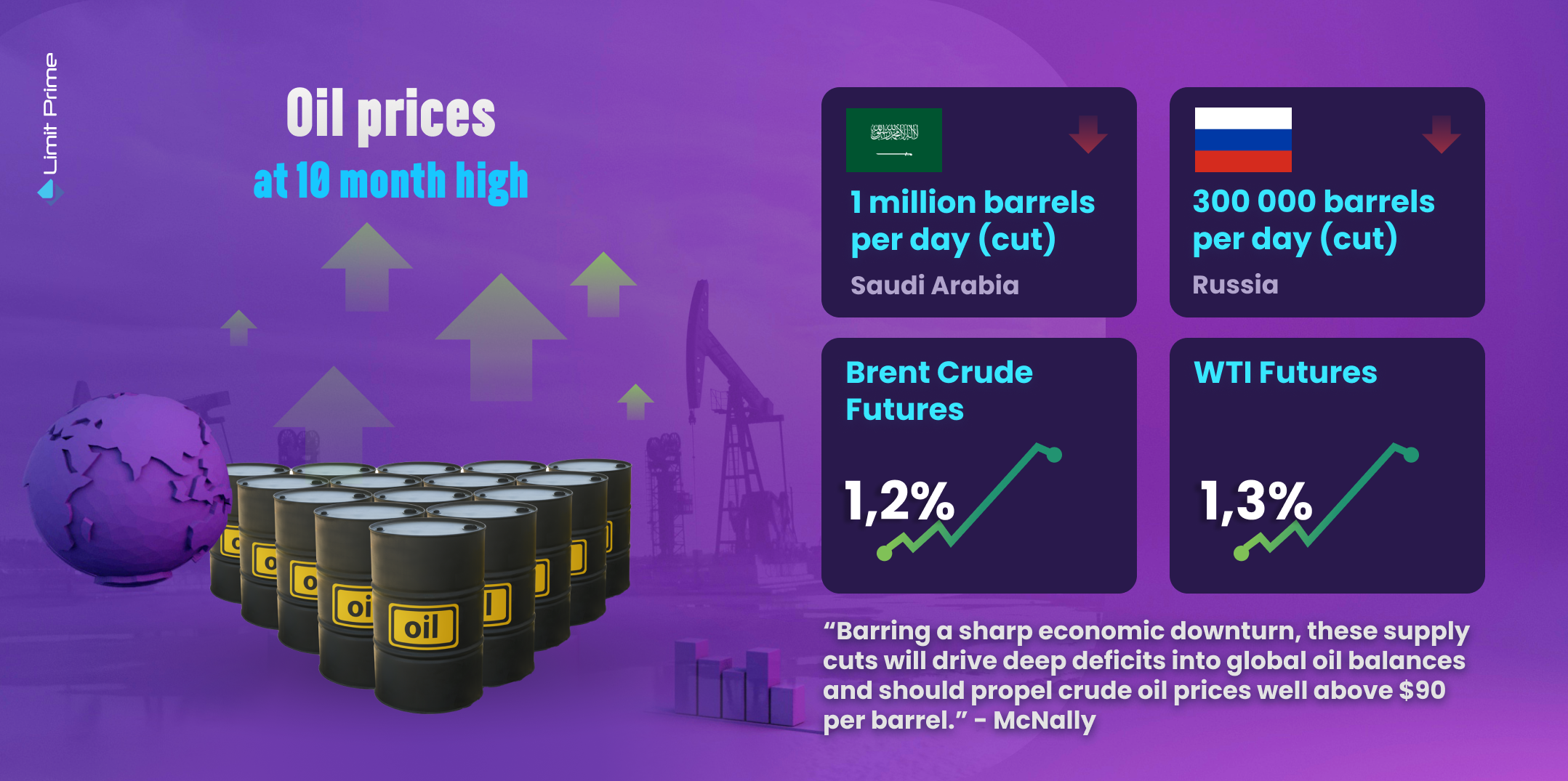

On Tuesday, there was a significant surge in oil prices following the decision of Saudi Arabia and Russia to extend their voluntary oil production cuts until the end of the year. Saudi Arabia reduced its daily production by 1 million barrels, while Russia implemented a 300,000 barrels per day cut. These actions were in addition to the amounts that had been agreed upon by several OPEC+ members back in April, which were set to continue until the conclusion of 2024.

As a result of these developments, Brent crude futures saw an increase of $1.04, equivalent to a 1.2% rise, settling at $90.04 per barrel. This marked the first time since November 16, 2022, that Brent crude closed above the $90 threshold. Similarly, U.S. West Texas Intermediate (WTI) crude futures experienced a gain of $1.14, or 1.3%, settling at $86.69 per barrel, reaching a 10-month high.

The decision about the cut in depth

Saudi Arabia and Russia agreed Tuesday to extend their voluntary oil production cuts through the end of this year, trimming 1.3 million barrels of crude out of the global market and boosting energy prices.

This move may contribute to inflation and result in higher gasoline prices for consumers, potentially straining Saudi Arabia's relationship with the United States. President Joe Biden had previously cautioned Saudi Arabia about partnering with Russia on such cuts, given Russia's involvement in the conflict in Ukraine. Saudi Arabia stated that it will continue monitoring the market and could take further action if necessary.

“This additional voluntary cut comes to reinforce the precautionary efforts made by OPEC+ countries with the aim of supporting the stability and balance of oil markets,” the Saudi Press Agency report said, citing an unnamed Energy Ministry official.

State-run Russian news agency Tass quoted Alexander Novak, Russia’s deputy prime minister and former energy minister, as saying Moscow would continue its 300,000 barrel-a-day cut. The decision “is aimed at strengthening the precautionary measures taken by OPEC+ countries in order to maintain stability and balance of oil markets,” Novak said.

Experts believe that Saudi Arabia and Russia are demonstrating their commitment to proactively managing the risk of oil prices dropping under challenging economic conditions. Unless there is a significant economic downturn, these production cuts are expected to create substantial deficits in global oil supplies and drive crude oil prices well above $90 per barrel, according to Bob McNally, founder and president of the Rapidan Energy Group and former White House energy adviser.

“Barring a sharp economic downturn, these supply cuts will drive deep deficits into global oil balances and should propel crude oil prices well above $90 per barrel,” McNally said.

Saudi Arabia is motivated to boost oil prices to support its “Vision 2030 plan”, which aims to transform the kingdom's economy, reduce its reliance on oil, and create new jobs. This plan includes ambitious projects like the Neom City development. But at the same time, Saudi Arabia must navigate its relationship with the United States.

The oil cuts affect the prices of gasoline too. The average gallon of regular unleaded gasoline in the U.S. stands at $3.81, according to AAA (American Automobile Association) just under the all-time high for Labor Day of $3.83 in 2012. Higher gasoline prices can increase transportation costs and ultimately push the prices of goods even higher at a time when the U.S. and much of the world are already raising interest rates to combat inflation.

Conclusion

The decisions made by Russia and Saudi Arabia impact oil prices the most. Despite a series of production cuts over the past year, oil prices have remained subdued due to weakened demand from China and global efforts to combat inflation. However, as international travel returns to pre-pandemic levels, the demand for oil is expected to increase.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More