The SEC vs. Ripple lawsuit - everything you need to know

18.05.2023

What is the SEC vs. Ripple lawsuit?

Ripple Labs was created in 2012 and its main goal was to offer financial institutions fast and affordable cross-border money transfers through their RippleNet network. To make this a reality, the business created the RippleNet network on which transactions in the form of a cryptocurrency called XRP can be settled in real-time. Over time, XRP expanded beyond its original use where the founders of Ripple Labs used XRP as digital assets to raise funds back in 2013.

That seems to really have pissed off the SEC (Securities and Exchange Commission), so they filed a lawsuit against Ripple Labs and its CEOs in 2020. The SEC's lawsuit was prompted by Ripple's deviation from the intended application of XRP and its use as a fundraising tool.

The SEC accused Ripple of conducting an unregistered initial public offering (IPO) of XRP, selling tokens to investors globally without proper registration, and allegedly said that Ripple offered billions of XRP in exchange for non-cash services.

What are SEC’s claims in Ripple’s case?

The SEC charged Ripple—and two of its executives, Brad Garlinghouse and Christian Larsen—with selling unregulated securities valued at more than $1.3 billion to the public over the years via their company-offered XRP.

Included in the SEC filing were transactions from 2013 through late 2020, which accounted for more than 14.6 billion XRP sold in return for cash.

And, The SEC said Ripple never filed a registration document, which is a requirement for companies in the capital market when they are seeking to raise capital from the public. The regulator complained in the lawsuit that Ripple had “created an information vacuum” and only shared information that it felt necessary. In simple terms, Ripple tried to hide it.

According to the SEC, XRP is considered a security. Security is typically a financial instrument that can be tradable and represents ownership or a part of a company, as security can be considered any other comparable entity that has no other practical use. For example, publicly traded companies (such as Amazon, Alibaba, Tesla, Coca-Cola, etc.) frequently describe shares as securities in order to raise money.

So, how did they determine that Ripple is considered a security?

The Howey test. This test states that a key consideration in assessing whether or not an investment contract is a security under the Securities Act of 1933 and the Securities Exchange Act of 1934. So pretty simple, if investors have no control over the asset, it is anticipated as security.

Therefore, did XRP pass the Howey test's requirements?

Securities must be registered with the SEC, and some financial data must be disclosed publicly, according to SEC regulations. The purpose is to protect investors’ interests while protecting them from fraud.

In the end, the SEC determined that XRP satisfied the Howey test’s requirements, and it is a security.

Timeline of events

After filing the lawsuit On December 21, 2020, on December 28, 2020, Coinbase, the major cryptocurrency exchange, announced the delisting of XRP from its platform due to the regulatory uncertainty speculations related to the token. Next, on March 3, 2021, Larsen and Garlinghouse submitted letters to the U.S. District Court Southern District of New York Magistrate, arguing that the SEC lacked fair notice regarding the regulatory status of XRP. In response to the letters, on March 8, 2021, the SEC requested an immediate hearing from the judge.

On March 22, 2021, Judge Netburn stated that XRP has a currency value and utility that distinguishes it from Bitcoin (BTC) and Ethereum (ETH).

Following the statement, on April 13, 2021, SEC Commissioner Hester M. Peirce published the Token Safe Harbor Proposal 2.0. This proposal aimed to provide a three-year grace period for developers to understand whether their participation in decentralized networks would be exempt from securities laws. The court granted an extension to the SEC on June 14, 2021, allowing them until August 31, 2021, to disclose their internal crypto trading policies. The deadline was till August 31, 2021.

The expert discovery deadline, which involved gathering opinions from experts in the fields of cryptography and securities, was set for October 15, 2021.

On January 24, 2022, Judge Netburn granted the SEC until February 17 to appeal her earlier decision, which required Ripple Labs to provide sensitive government documents in the SEC's case alleging that XRP is an unregistered security.

What are the latest news regarding the lawsuit?

The US SEC filed a request to the Court on December 22nd to seal the controversial documents related to Hinman's speech, but the federal judge ruled that the U.S. Securities and Exchange Commission cannot seal documents tied to former official William Hinman's 2018 speech on crypto and securities to Ripple in the regulator's ongoing lawsuit against the company closely associated with the XRP cryptocurrency. The documents of Hinman's speech refer to a speech given by former Director of the SEC's Division of Corporate Finance, William Hinman, at the Yahoo Finance All Markets Summit in June 2018. In the speech, he allegedly stated that Ethereum (ETH) is not a security and Ripple included the documents of Hinman's speech as evidence.

Judge Analisa Torres rejected the SEC's request on May 16th, marking a victory for Ripple.

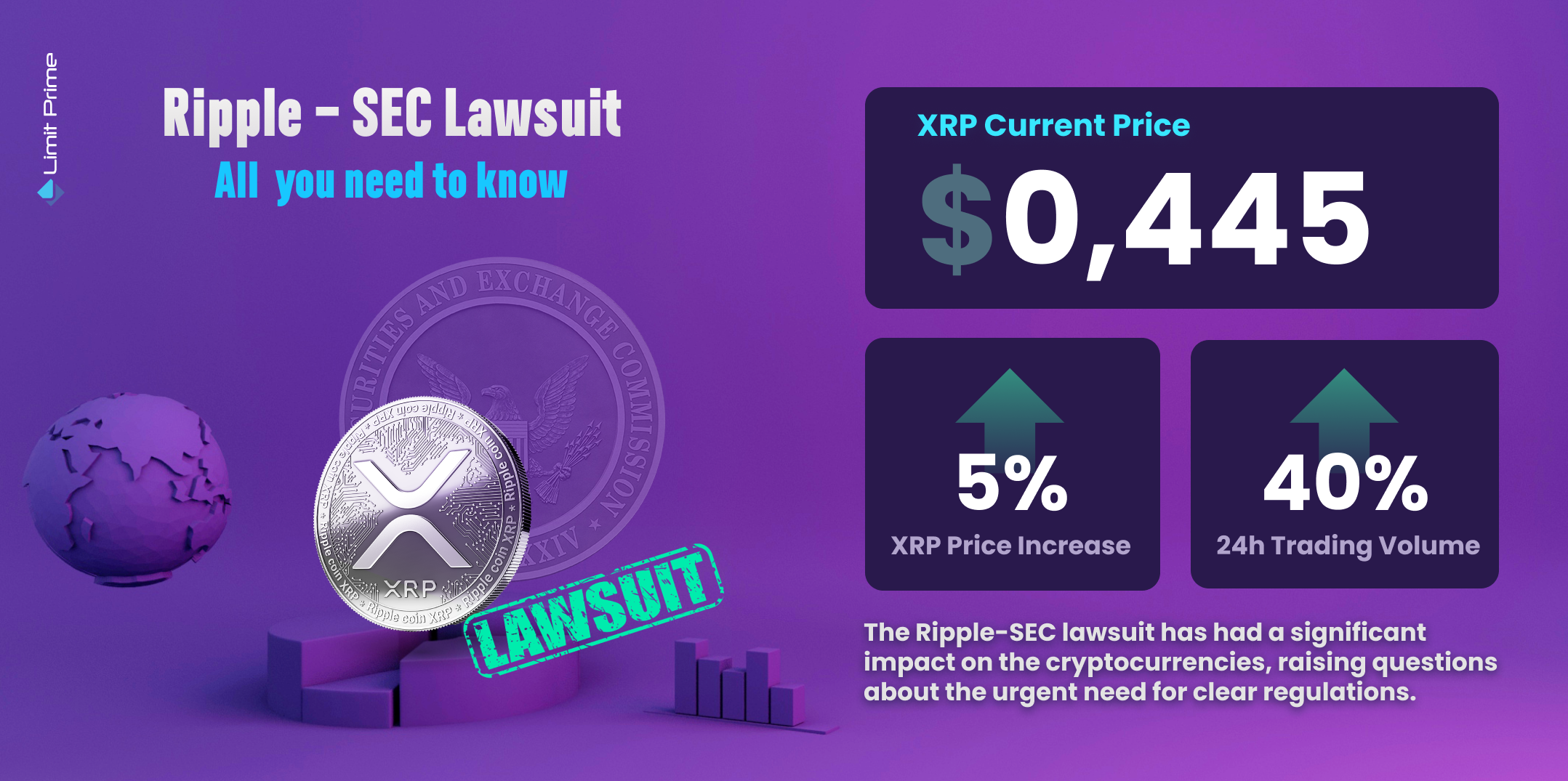

XRP experienced a 5% growth after the court's decision.

What is happening with the price of XRP?

The price of Ripple (XRP) surged on this timeline of events, showing significant daily growth of 5.35%. A 40% increase in trading volume within 24 hours brought back the enthusiasm of investors. If investors maintain the existing upward trend, the price of Ripple could rise above the current market value of $0.445 and break the psychological barrier of $0.450.

What is next for Ripple Labs?

Ripple said Wednesday it has acquired Metaco, a Swiss firm that holds digital assets securely on behalf of clients, in a bid to expand its international footprint and broaden its range of services.

Ripple and Metaco share a strong cryptocurrency DNA and a long history of working with regulated entities. With this acquisition, Ripple will expand its enterprise-level offerings by providing customers with technology for the custody, issuance, and settlement of any kind of tokenized asset. And Metaco will significantly grow through access to Ripple's established customer base of hundreds.

Brad Garlinghouse, CEO of Ripple, stated that Metaco is a proven leader in institutional digital asset custody with an exceptional executive team and an unmatched record of customers. With hopes that Metaco will expand Ripple’s global and digital footprint.

Did Ripple win the lawsuit?

Ripple has claimed a major victory in its continuing legal battle with the SEC. So, hopefully, all of this drama will work out in favor of Ripple.

Conclusion

In conclusion, the Ripple-SEC lawsuit has had a significant impact on the cryptocurrency industry, market, and assets raising questions about the classification of cryptocurrencies and the urgent need for clearer regulatory guidelines. While the outcome of this huge lawsuit is still pending, the case has sparked discussions about the Howey test and the necessity and nature of digital assets.

This legal battle highlights the importance of regulatory clarity to prevent confusion and legal challenges within the crypto-verse.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

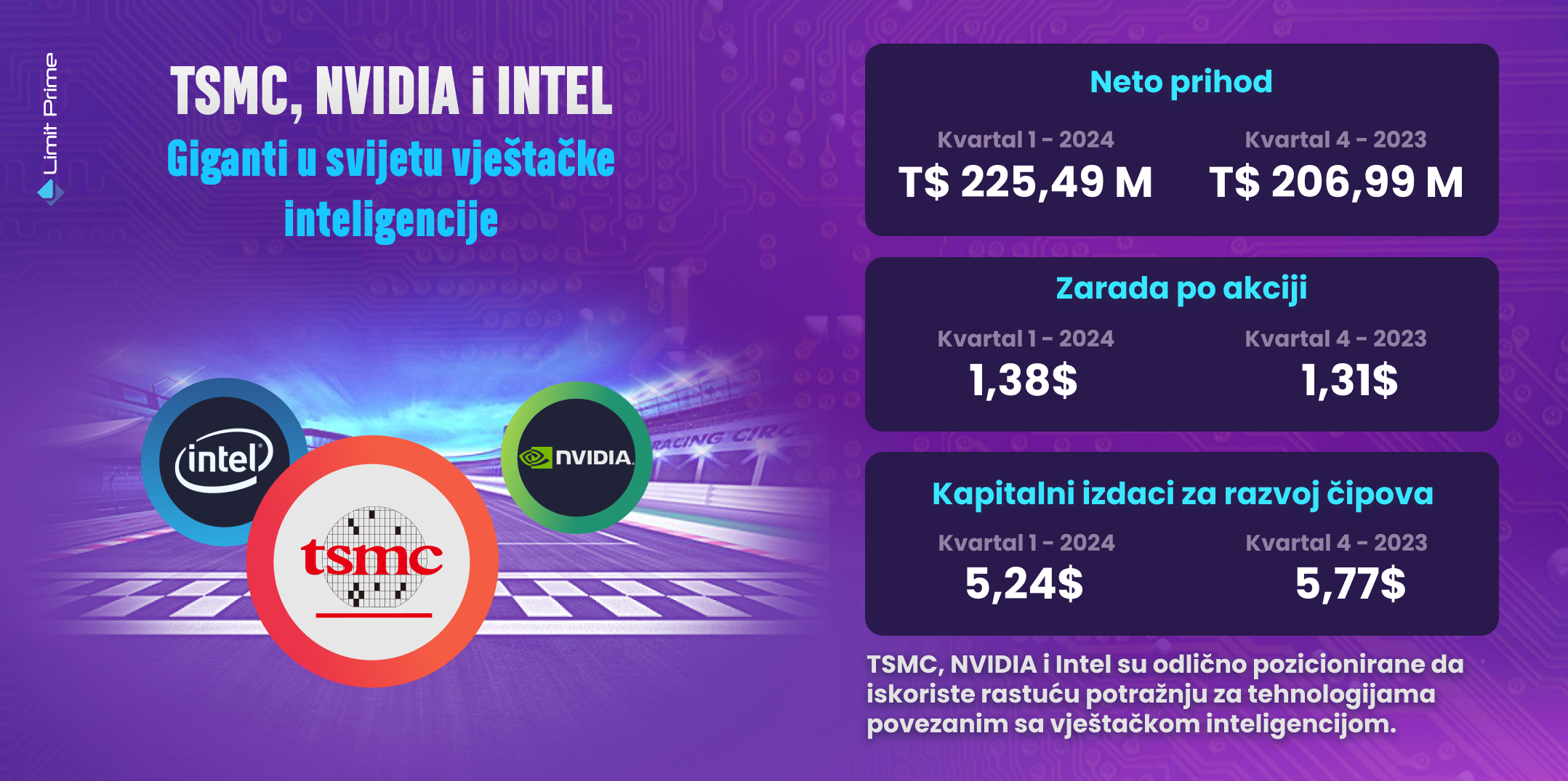

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More