Tesla - Q2 Results

03.08.2022

The Q2 report that was released on July 20th 2022 showed revenues of approximately $16,934 billion (about $400 million more than Wall Street expected) and earnings per share of $2.27 (Non-GAAP versus $1.81 expected by Wall Street).

This automaker giant managed to increase its cash position by $0.8B to $18.3B during this quarter.

They also pointed out all of the struggles that they faced this time around, but Tesla proudly made it out with strong results and with an impressive operating gross margin.

“We continued to make significant progress across the business during the second quarter of 2022. Though we faced certain challenges, including limited production and shutdowns in Shanghai for the majority of the quarter, we achieved an operating margin among the highest in the industry of 14.6%, positive free cash flow of $621M and ended the quarter with the highest vehicle production month in our history.” - the company noted.

Automotive revenues made up $14.6 billion of the company’s total, with $1.47 billion coming from services and other revenue, and $866 million came from the company’s energy segment.

Unfortunately, one concern stood in the way of Elon’s business - which is the automotive gross margin falling for the first time in a long period to a point of 27.9%, nevertheless analysts suggest that even in times of experiencing a decline this is still a good percentage, marked between the best ones in the car-making industry.

Automotive gross margin was seen at a percentage of 27.9, falling down from 32.9% for Q1 and falling from 28.4% seen a year ago.

A reasonable explanation for this loss would obviously be the inflation and the increased competition that produces battery cells and other components that go into electric vehicles.

The company generated $344 million in automotive regulatory credits revenue in the second quarter. That’s a $10 million or nearly 3% decline from the same period in 2021.

Tesla didn’t go into the details of their sales and investments, but selling their Bitcoin spiked the interest of trading communities. They noted that 75% of their bitcoin purchases was transformed into fiat currency - or simply said sold. In addition to this, we clearly remember when Tesla caused chaos among crypto enthusiasts when it announced in early 2021 that it had purchased $1.5 billion worth of bitcoin.

Musk said: “The reason we sold a bunch of our bitcoin holdings was that we were uncertain as to when the covid lockdowns in China would alleviate so it was important for us to maximize our cash position.” He continued, “This should not be taken as some verdict on Bitcoin.” They gained $936 million from selling the cryptocurrency. But unfortunately Tesla hasn’t sold any of its Dogecoin.

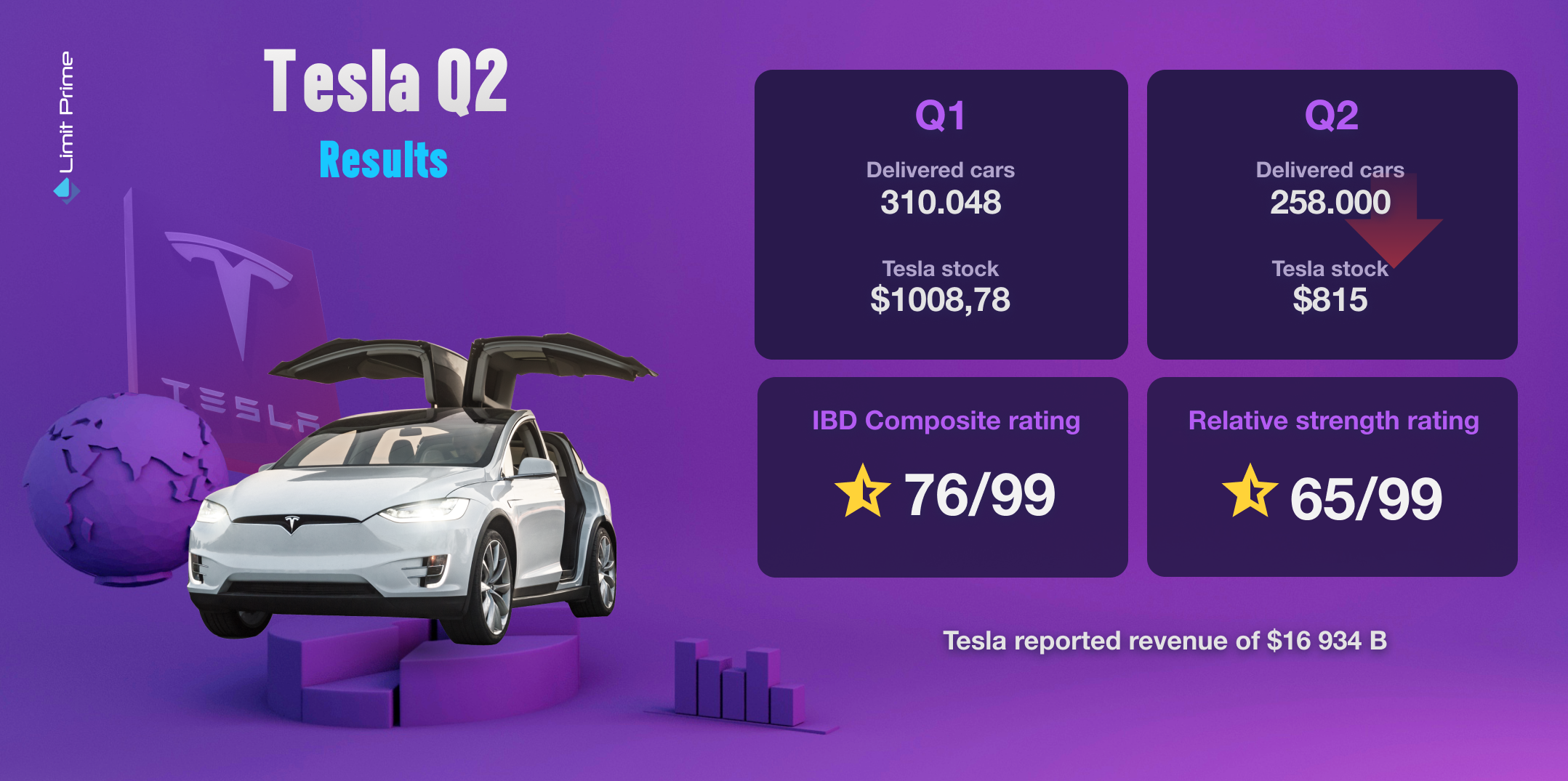

Production levels for Q1 and Q2

In the month of April, Tesla reported vehicle delivery of 310,048 for the first quarter.

The famous Model 3 and Model Y vehicles equaled 95% of the total delivery, or in simple numbers around 295,324 vehicles.

If we take a look at the second quarter, 258,000 cars were successfully delivered. During the earnings call, Elon Musk - the tech king and CEO of Tesla said that the factory just right outside of Berlin had production of around 1000 cars per week during the period of June.

Making it the highest vehicle production month in Tesla's history. And he also placed his expectations for the factory in Austin, Texas. It is expected that production in Texas will exceed the 1000 cars produced in one week in Berlin.

But production is down by 18%, compared to the previous quarter.

Tesla reported 709 store and service locations and 3,971 Supercharger locations growing its charging infrastructure, the stores and the service locations number increased too but not significantly. Representing 19% growth in store and service center locations year-over-year and a 34% growth in the number of charging locations.

On June 28, the White House said Tesla was working to open its Supercharger network to other EVs in the U.S. by the end of 2022, which means more revenue for Tesla.

When the demand for Tesla vehicles stays the same or even potentially expands as Elon is forecasting, it helps the stock market to move up and satisfy Tesla’s shareholders and investors.

Stock movement after publishing the results of Q1 and Q2

After the release of Q1 the results were not enough to set a new lasting uptrend for TSLA stock. The stock’s price was $1008,78, in the trading after hours, but just 6 days later the stock declined to $876.42 by 12%.

The decline was most likely caused because of Elon Musk’s tweets, as well his decision to buy Twitter and turn it into a private company. Investors were worried that the focus of Tesla’s CEO wasn’t entirely on Tesla, but sadly Elon withdrew his offer and is currently going through a lawsuit.

Which brings us to today’s stock condition.

We can clearly see on Tesla’s charts that it is nearly impossible to maintain an uptrend, almost three months after its drastic decline. Shares rose as high as 6% in after-hours trading, after publishing the Q2 results, placing at about $815 a share.

According to the IBD Stock Checkup tool, Tesla stock has an IBD Composite Rating of 76 out of 99 and a weak Relative Strength Rating of 65 out of 99. The rating means that Tesla stock has outperformed 65% of all stocks in the IBD database over the past 12 months.

Tesla’s stock climbed above the 50-day average for the first time since May 4. Meaning it started moving and progressing, but it’s far away from the prior stability and high digits.

How is TSLA trading?

On July 13, Tesla AI chief Andrej Karpathy made it public that he was leaving the company. But before that, Elon Musk said the company would fire 3.5% of its employees. This might negatively impact the stock. Also, Tesla reported better-than-expected Q2 earnings on July 20, but still has a long way to go.

The shares are now trading at around $842. On a daily chart, they are in a long process of reaching a point over $1000.

What might influence the price of Tesla's stock in the future?

Sometimes only - Elon Musk and his tweets.

Other times, besides that here is a list of possible other factors:

- Recent upgrades in Shanghai will lift the production rate from this factory in the future.

- In Europe, Tesla can see the production rate increasing through the year.

- In the US, Tesla will boost production rates. For example, in Texas, they can now produce vehicles with either structural batteries or legacy batteries.

- A plan to organize a vote at its August shareholder meeting for doing a 3-to-1 stock split. The company thinks that the demand for their shares has increased and their lower-priced shares will be more accessible to everyone and to the new investors.

Overall, Tesla is planning to boost manufacturing as “quickly as possible”.

Conclusion

Tesla's Q2 result didn’t disappoint, this huge automaker shared its strong cash flow, growing revenue and production details with the world. It reported a revenue of $16,934 billion and $2.27 earnings per share.

However, the production levels of Tesla disappointed, so far the general production expected better results than the Q1, unfortunately that didn’t happen. Only 258,000 cars were produced.

The company is forecasting it can achieve a 50% increase in the average annual growth rate of vehicle deliveries.

Tesla’s stock is now trading around $776, it shows signs of a slow progress.

Hopefully there will be a bullish market for this stock in the near future, cause TSLA almost never disappoints.

LimitPrime © 2026

Categories

Leave comment

Comments

READ MORE INTERESTING ARTICLES

In today's chip-making world, there's a new kid on the block: artificial intelligence (AI). Several companies are changing the...

Read More

What is Bitcoin Halving?Bitcoin halving day is eagerly anticipated by crypto enthusiasts and investors, and of course, it marks a cruci...

Read More

In the evolving world of cryptocurrency, where Bitcoin and Ethereum often take center stage, there isn't much focus on the other di...

Read More